📈Weekly Charts📉 September 13, 2025

Strength Across the Board

✔️ New highs.

✔️ Broad participation.

✔️ Even bonds are breaking out.

Seasonal concerns remain, but the weight of the evidence is still bullish — for now.

Let’s zoom out and break it down 👇

📊 U.S. Indexes: Resting Near Highs

S&P 500 (SPX):

📈 Another new weekly closing high — up ~3.5% from last week’s low

📊 Volume above average

😎 RSI rising but not overbought (68.22)

💪 Momentum and structure remain strong

Nasdaq 100 (QQQ):

✅ New all-time closing high

📈 Up ~4.75% from last week’s dip

🔊 Firm volume, climbing RSI

📏 Bollinger Bands tightening — watch for expansion

Big tech leads again.

Dow Jones (DIA):

✅ Cleared prior resistance with conviction

📈 Trading well above 10- and 40-week MAs

🧱 Bullish structure forming

💥 Confirmed by strong breadth

The laggard steps up.

🌍 Small Caps & International

Russell 2000 (IWM):

✅ Ended positive, joining the other indexes

📍 Closed just below the ~$244.98 pivot

⚙️ Still working through resistance

Participating — but at its own pace.

All Country World ex-US (ACWX):

✅ New YTD high

🔊 Volume strongest since March

📈 RSI holding in the mid-60s

“Rest of world” showing steady strength.

China (FXI):

🔹 Pressed within ~$2 of 2021 pivot high

🔹 RSI breaking new ground

🔹 Volume average

🔹 DeMark 9 setup suggests a possible pause

Constructive, but not through resistance yet.

Bonds & Commodities

Bonds – AGG / TLT / HYG:

🔸 AGG extended its breakout, pushing above key pivot

🔸 TLT cleared resistance and is holding above major MAs

🔸 HYG hit new multi-month highs in trend

Lower-rate anticipation driving bond strength.

Commodities – GSG, GCC, USCI, DBP, DBA, etc.:

Commodities - as a group - continue to stagnate. At least this grouping. Some others show much more upward progress. GCC and USCI, for instance.

Note to self: compare the constituency across the different commodity indices.

Looking inside the group shows something different.

📊 Charts shared without commentary:

Precious Metals: DBP, GLD, SLV

Base Metals: DBB

Agriculture: DBA

Some segments are showing impressive strength.

U.S. Dollar: Stuck in the Same Struggle

U.S. Dollar Index (DX1! / DXY):

🔹 Still stuck mid-range

🔹 Long upper shadows = persistent selling pressure

Dollar weakness continues to support risk.

₿ Crypto Check

Solana (SOL): deserves the top spot this week.

🔹 Surged into the pivot zone near $260

🔹One of the week’s strongest crypto performers

🔹 Structure remains bullish, with no signs of exhaustion

🔹 Volume picked up, confirming the move

Clear relative strength.

Ethereum (ETH):

Also had a big week, bouncing back nicely from the DeMark 9 sell setup and resulting pullback.

Litecoin (LTC):

🔹 Positive week, holding above key moving averages

🔹 Structure remains intact, but upside follow-through is lacking

🔹 Still stuck below downtrend resistance

🔹 RSI stable — neither stretched nor weak

Holding ground, but still needs a catalyst.

Bitcoin (BTC):

🔹 Rebounded with the broader crypto space, but still lagging peers

🔹 Structure remains choppy — not bearish, just indecisive

🔹 Volume has been light

It's trying to participate — but not leading.

XRP (Ripple):

The pattern has changed, but the potential measured move price objective remains.

Relative Strength & Participation

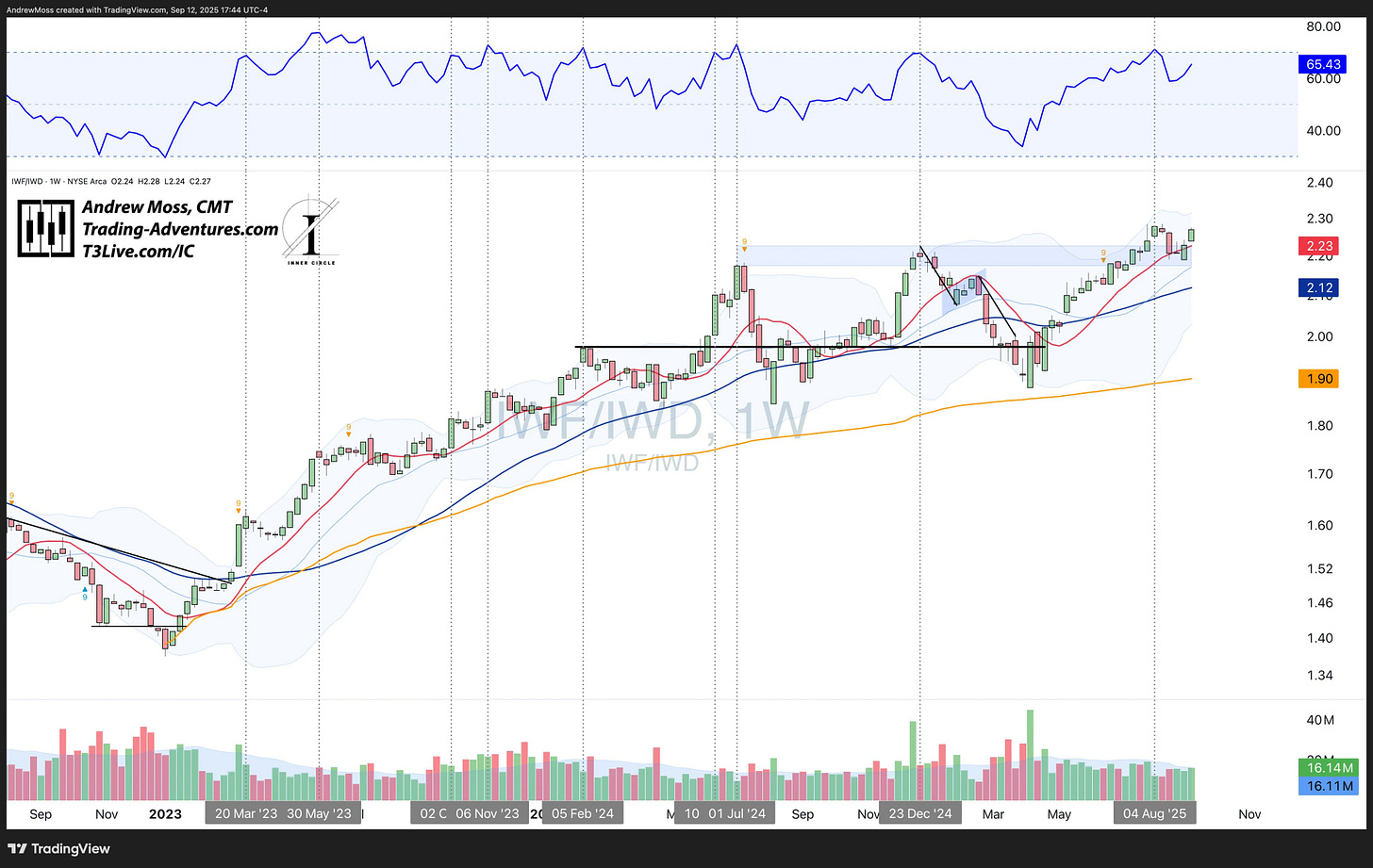

Value vs Growth (IWF vs IWD):

Growth reasserted itself after a brief RSI shift toward value. This week’s move reaffirms risk appetite and favors momentum.

Discretionary vs Staples (XLY vs XLP):

Growth reasserted itself after a brief RSI shift toward value. Now approaching recent highs — another vote for offense.

High Beta vs Low Volatility (SPHB vs SPLV):

High Beta surged ahead — risk appetite strengthening.

For more on Relative Strength, see the Chart School lesson:

Breadth: Quiet Strength Under the Surface

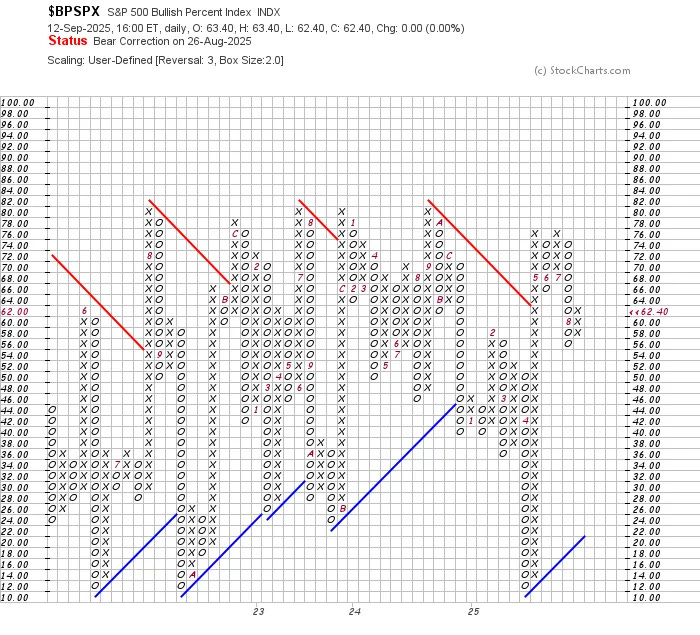

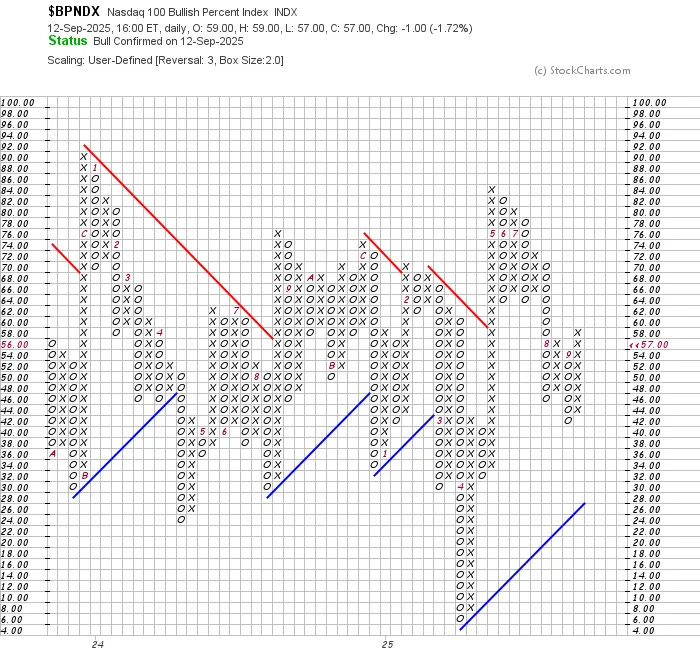

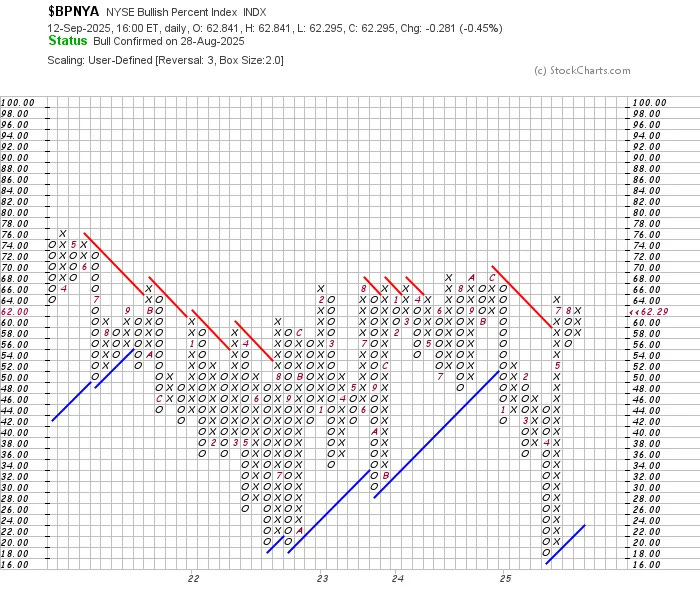

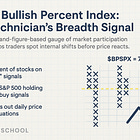

Bullish Percent Indices

$BPSPX - SPX: has done exactly nothing since our last check-in

$BPNDX - NASDAQ: Added a new column of Os, then quickly reversed into a higher column of Xs

$BPNYA - NYSE: Also unchanged — stuck in the same column$BPSPX – S&P 500

SPX % Above 50/200 MAs

Still riding well above the 50% level

Typical back-and-forth, but no major deterioration

Breadth remains quietly constructive under the surface.

Understanding the Bullish Percent Index

A timeless signal of internal strength, built on point & figure roots.

Now What?

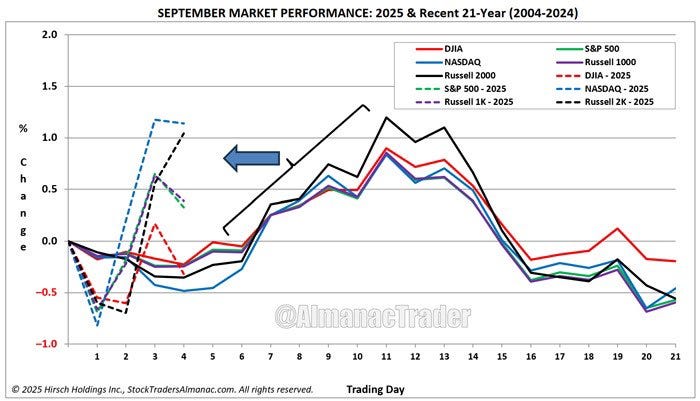

Short-Term:

- Short-Term

Markets are strong. New highs continue to stack up.

Participation is broad and healthy.

FOMC decision looms — rate cut odds are high, but still uncertain.

Seasonal headwinds remain a risk, even if they’re being ignored for now.

Jeff Hirsch shared this at the TSAA-SF Conference last week. It's a good consideration.

Could an FOMC rate cut this week be a 'sell the news' event?

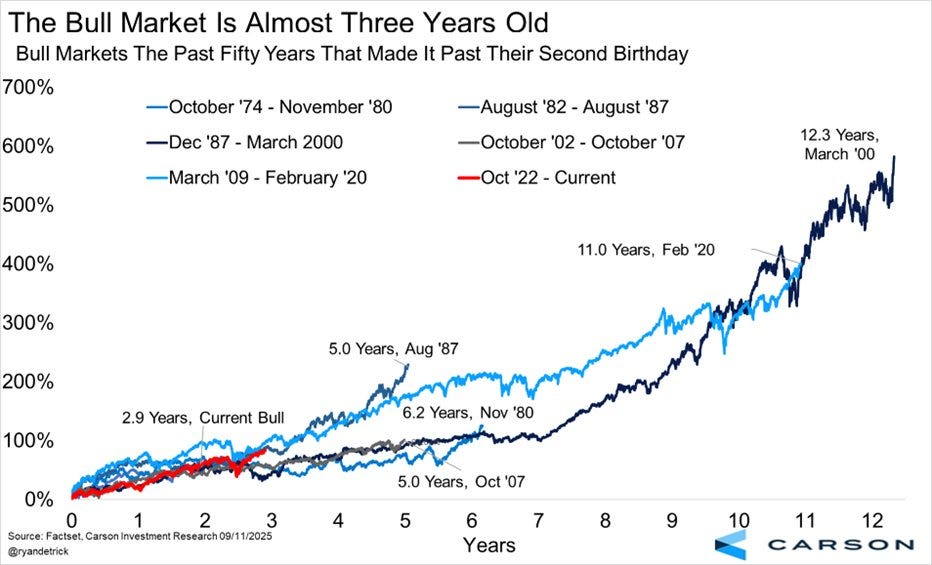

Looking out further -

Trends are intact.

Leadership is clear.

Participation is strong.

Here’s Ryan Detrich with a look at the cycle.

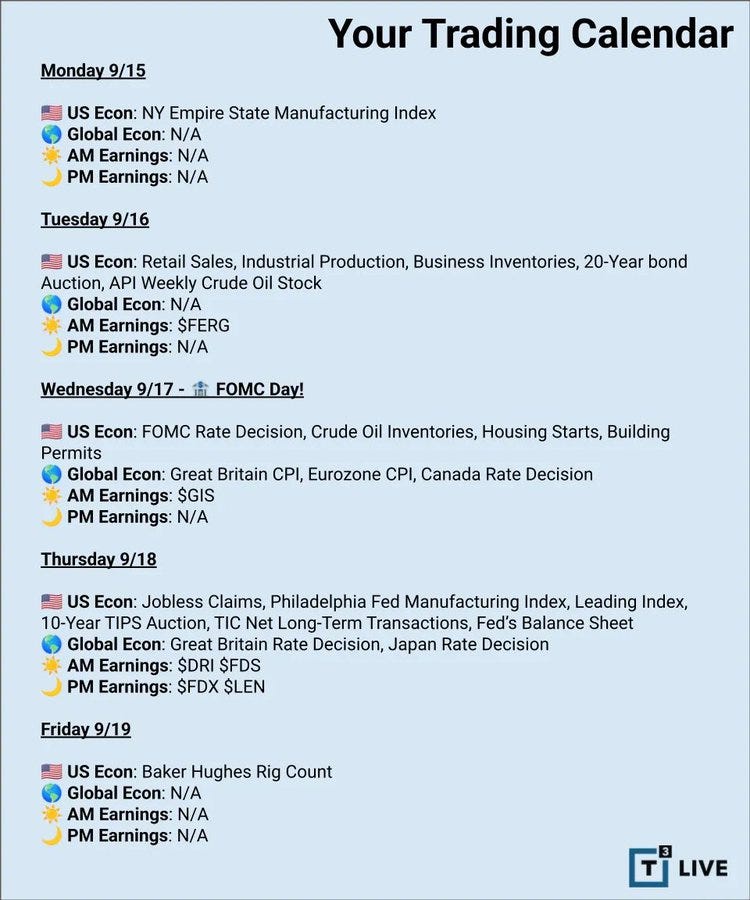

📅 The Week Ahead

🔹 FOMC on Wednesday — key risk event

🔹 Minimal earnings / econ data otherwise

🔹 Quad witching Friday = potential volatility

Stay sharp. Let price lead.

ICYMI

My recap of the TSAA-SF conference is out. It was truly an honor to be there. Many sharp minds shared great insight and deep market discussions.

Read it all here.

🧠 Final Thoughts

That’s it for this week’s look at the 📈Weekly Charts📉. Each week, I share this to help you see what I’m seeing and prepare for what’s ahead.

📈 Market structure

📊 Breadth and participation

🧠 Sentiment, macro shifts, technical confirmation

It’s all part of a process. And preparation is everything.

Thanks for Reading

If you’ve found these weekly breakdowns useful, here’s how you can help keep them coming — consider a paid subscription:

All posts remain public. No locked content. Just charts, signals, and steady updates to help you navigate markets with confidence.

And don’t forget to Like ❤️ Comment 💬 Share 🔁 too.

—Andy

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Hi Andrew, I read you article almost every week. Like it. But one little suggestion, can you use simple "dot" format to start with the dot point. As I use "ReadAloud" app to reading your article is cause some annoyance with all the fancy "Dot". Your help would be much appreciated.