📈Weekly Charts📉 September 20, 2025

Momentum names soar to targets while leadership broadens. The question: rotation or exhaustion?

It’s been a big week!

Fed cut rates

Indices pushed to new highs

Small caps reclaimed leadership

And leaders kept pressing higher

Let’s take a look at the charts that matter most.

📊 U.S. Indexes

Russell 2000 (IWM)

Gets the starting spot this week with a new all-time high weekly close. It’s been a long road back to the $240s — a level that’s been resistance before. Volume was heavy this week. RSI not yet overbought. The question now — follow-through or another stall?

The next extension level higher doesn't come in until near ~$295s. Below, there is potential support near ~$229–$230, the 10-week MA and the AVWAP from the July test of support pivots and the 40-week MA.

S&P 500 (SPX)

$SPX extended its bounce from the 10-week MA, taking RSI > 70, and moving on high volume. 7000 and the 1.618 extension are getting closer.

Nasdaq 100 (QQQ)

$QQQ with its 3rd week higher as well, nearing the upper Bollinger Band while taking the weekly RSI > 70 and into overbought status. Volume was also above average.

Dow Jones (DIA)

$DIA rounds out the perfect 4/4 week. RSI at 64 leaves plenty of room for more momentum, and the next extension is $504.22. Support could be found near $449–$451.

🌍 International

ACWX (All Country World ex‑US)

Moving overseas — $ACWX The Rest Of The World was up too, but with a potential topping candle in the form of a shooting star at the upper Bollinger Band. That's one sign of extension. On the other hand, the 10-week MA isn't that far below, and RSI is still below 70. This could pull back into the lower $60s from here, or push on towards the next extension level at $71.74.

FXI (China)

$FXI has a similar look, but with the added factor of a retracement level adding some resistance. RSI followed prices higher, while the DeMark 9 setup has proven to be (at least) a week early.

🧱 Bonds

High-quality bonds with a bit of an about-face this week. $AGG and $TLT reversed last week's breakout action. But high-yield buyers were still present, taking $HYG smoothly upward along the trend area.

AGG

TLT

HYG

💵 U.S. Dollar

$DXY / $DX1! The Dollar showed signs of life with a strong reversal off the pivot, leaving a very long lower shadow on this weekly candle. There should be plenty of resistance just above, so this is far from a decisive move. We'll see if price action confirms in coming weeks.

🛢️ Commodities

Rather than the usual look at the very energy-focused $GSG, we'll go straight to some specific areas, and add one new one for energy.

DBP — Precious Metals continue higher with resounding strength

DBB — Base Metals take a rest after last week's breakout

DBA — Agriculture moved sharply lower to a key potential support level, where price history, a trendline, and the 10/40-week MAs all come together.

DBE — Energy continues to grind sideways near the MAs and a key AVWAP.

₿ Crypto Check

Bitcoin (BTC)

What's it going to take for Bitcoin to move past this consolidation and on to the next extension near ~$155k? A good squeeze perhaps? The Bollinger Bands are about as tight as they’ve ever been in recent years, a condition that has often preceded higher moves.

Ethereum (ETH)

Still in a high-level bullish consolidation pattern. ~4867 is the pivot high and ~7300 is the extension level.

Solana (SOL)

Still working on the $260 pivot. The 1.618 extension is at $415.74. Note: the log scale makes this chart look different, so two versions are included.

Litecoin (LTC)

Keeps getting tighter and tighter holding the pivot, the 10-week MA, and the ATH AVWAP.

XRP

Small inside week between the 10-week MA and pivot low AVWAP.

🔁 Relative Strength & Participation

Value vs Growth: IWF vs IWD

Growth beat value for a 3rd week in a row. RSI is nearing 70 again. Interesting that rapid successive tests have resulted in additional pullbacks.

XLY vs XLP

SPHB vs SPLV

To learn more about Relative Strength, read this Chart School article:

🧠 Breadth

% Above 50/200 MA

$SPX screamed higher this week. But the % of stocks above a 50 and 200-day MA decreased.

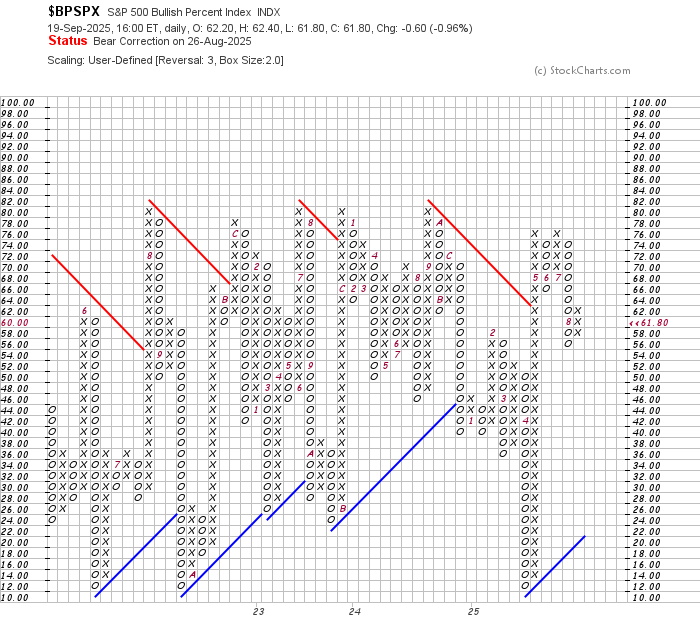

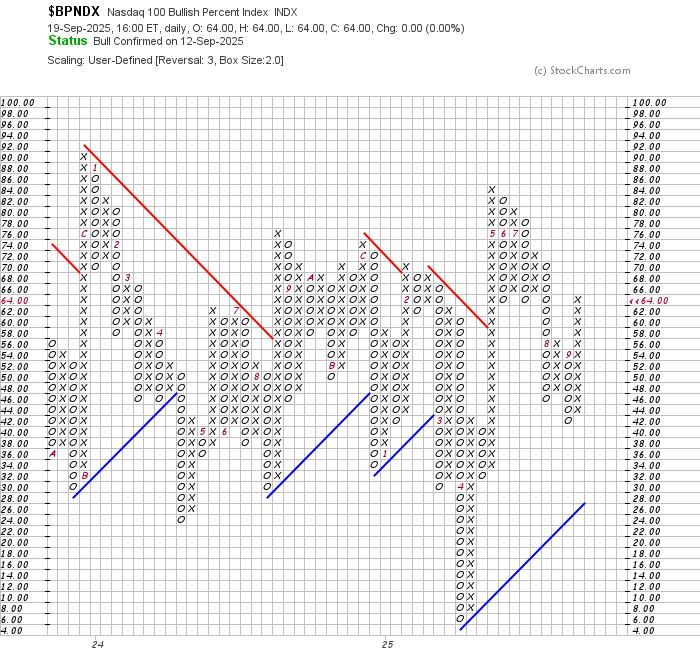

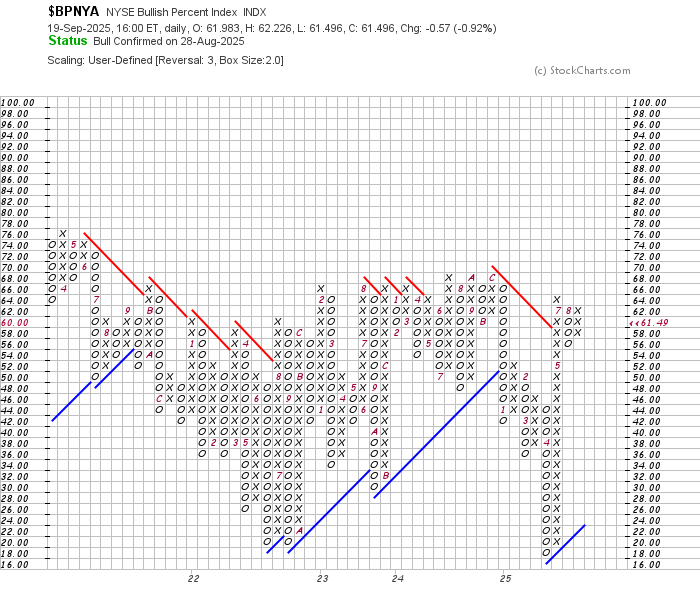

Bullish Percent Indices (BPIs)

$BPSPX — no change in columns, though the count decreased slightly from last week.

$BPNDX — strengthened, adding to its column of Xs.

$BPNYA — holding steady.

🧭 Now What?

Short-Term

Late September into early October has a history of seasonal weakness — often one of the choppiest stretches of the year. With $SPX % above 50/200 MAs slipping even as indices push higher, we could see digestion or a shakeout before the next leg.

Medium-Term

The growth/value ratio ($IWF / $IWD) is leaning heavily toward growth again, but repeated overbought tests have led to pullbacks in the past. Combined with froth in momentum names — many ripping to lofty extension targets almost effortlessly — this raises the odds of mean reversion.

Long-Term

Despite froth, the primary trend remains higher. Rotation into small caps alongside mega-cap tech strength signals a broadening bull market. If seasonal chop passes without real technical damage, the setup into Q4 stays constructive.

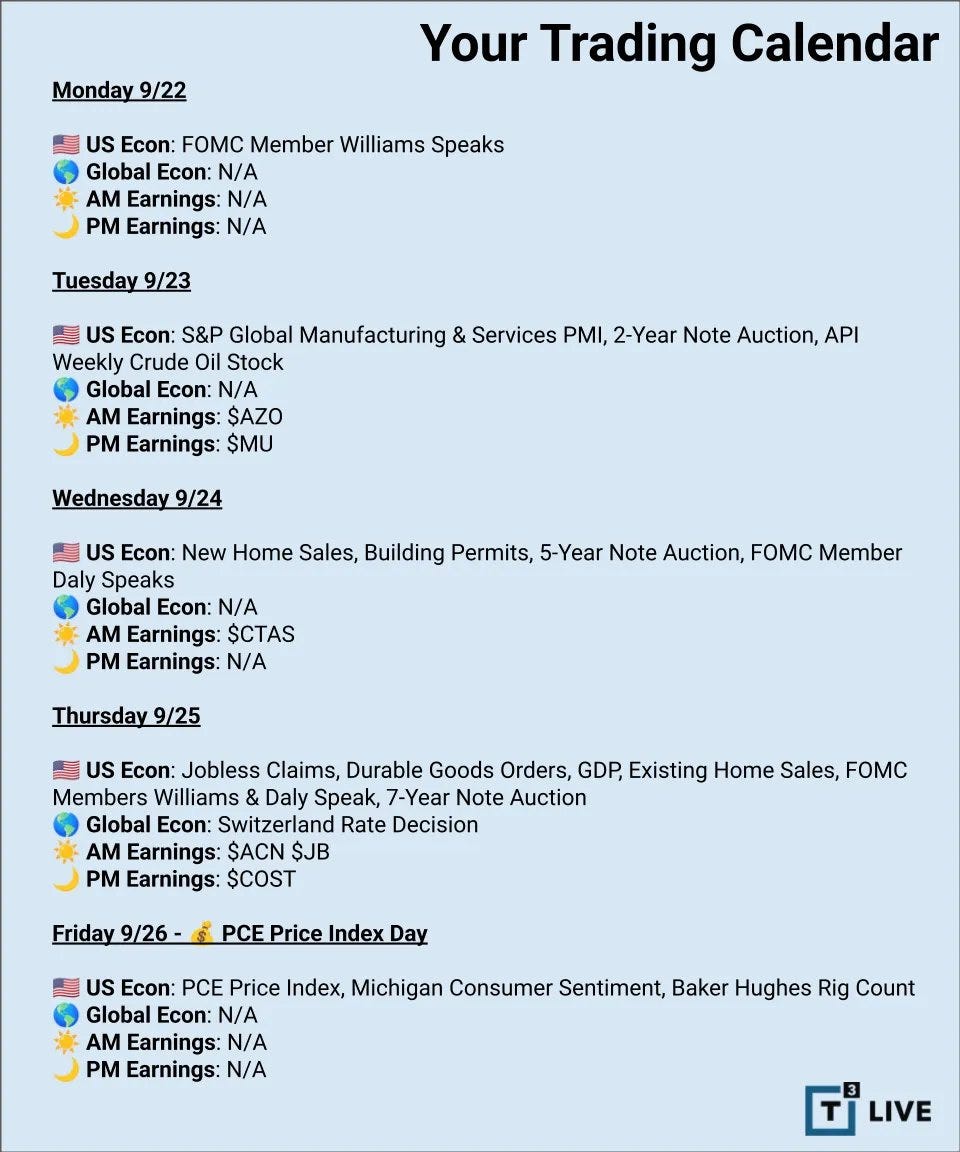

🗓 The Week Ahead

Mon — No major catalysts — expect markets to digest OPEX flows.

Tue — Housing data (Existing Home Sales) — watch $XHB / $NAIL for reaction.

Wed — Fed speakers hit the circuit — tone/direction after last week’s cut will matter for rates/credit.

Thu — Jobless Claims + GDP revision — always potential for intraday chop.

Fri — PCE inflation (the Fed’s preferred gauge). This one can move markets into month-end.

Seasonality reminder: late Sept / early Oct = historically choppy tape. Layer macro catalysts on top and expect volatility spikes.

🧠 Final Thought

Momentum is strong, leadership is broadening, and buyers keep stepping up. But with OPEX behind us and late-September seasonality ahead, look out for a noisier tape. Respect the trend. Stay tactical.

Thanks for Reading

If you’ve found these weekly breakdowns useful, here’s how you can help keep them coming — consider a paid subscription:

All posts remain public. No locked content. Just charts, signals, and steady updates to help you navigate markets with confidence.

And don’t forget to Like ❤️ Comment 💬 Share 🔁 too.

—Andy

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew, thanks for all the great work you did on the market review this week. Cheers.