📈Weekly Charts📉 September 27, 2025

Markets wrapped a choppy but constructive week.

Let’s run through the indexes, bonds, commodities, crypto, and key internals to see where things stand heading into October.

📊 U.S. Indexes

S&P 500 (SPX): Inside week near the highs on good volume with RSI back below 70. With two trading days left in the month, September is set to finish strongly.

Nasdaq 100 (QQQ): Inside week. RSI > 70. Good volume. Momentum still intact.

Dow Jones (DIA): Pushed to new highs before pulling back into another inside week. Plenty of room higher on RSI. Potential support near $451 with the 10-week MA catching up to the pivot.

🌍 Small Caps & International

Russell 2000 (IWM): Paused at the key pivot. Does it move on to the bonus tracks, or spin lower and force a new playlist?

ACWX (ex‑US): Last week’s potential topping candle confirmed. Deeper selling and a lower close than U.S. indexes hints at more downside. Watching the rising 10‑week MA as potential support.

FXI (China): Short‑term topping candle confirmed at a key retracement. Momentum cooling. Watching support near $39. A deeper dip would test conviction.

🧱 Bonds & Commodities

Bonds (AGG / TLT / HYG): AGG and TLT continued last week’s reversal.

High‑yield HYG tracked equities, riding the trend.

Dollar (DXY / DX1!): Follow‑through off the pivot confirms last week’s “showing signs of life.” Plenty of resistance overhead, but the tone shifted from breakdown to fight‑back.

Commodities (GSG): Working to “un‑stick” above the $23.15 pivot. DBP still the group leader.

₿ Crypto Check

Bitcoin (BTC): Dips further into a 21‑week consolidation. ~$100k–$115k range remains unbroken. Key AVWAP near ~$106k. RSI back toward 50% — watch if BTC can hold the bullish upper half.

Ethereum (ETH) and Solana (SOL): Both found support at AVWAPs from the June pivot lows.

Litecoin (LTC): Pressed a bit deeper to the AVWAP from the June lows.

🔁 Relative Strength & Participation

Growth vs. Value nearly printed another 70+ RSI.

IWF / IWD

Discretionary kept leading Staples.

XLY / XLP

High beta vs. low volatility (SPHB vs. SPLV) reversed from overbought RSI.

Risk appetite still shows in leadership, even as momentum cooled slightly.

If you want a refresher: Relative Strength — What Is It? (Really) in the new Chart School section.

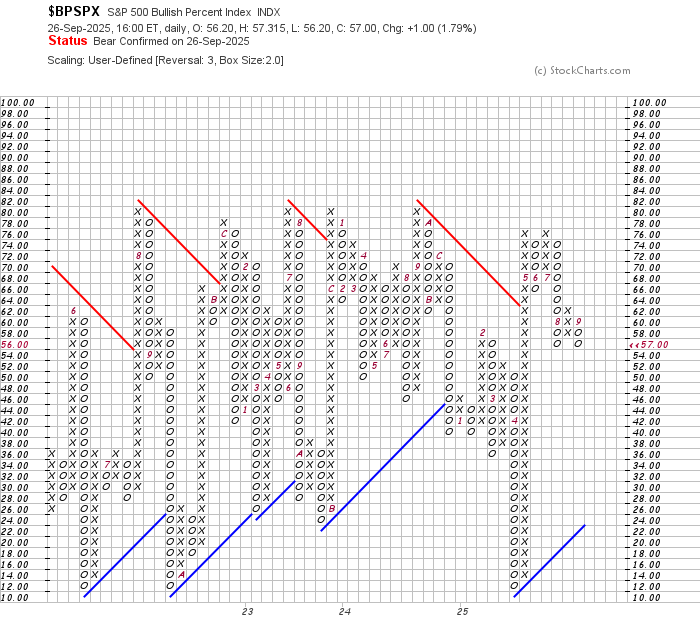

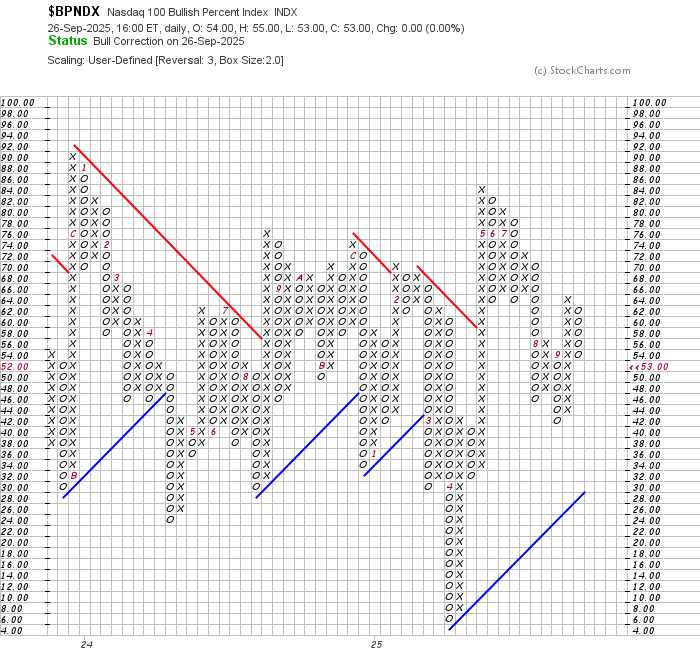

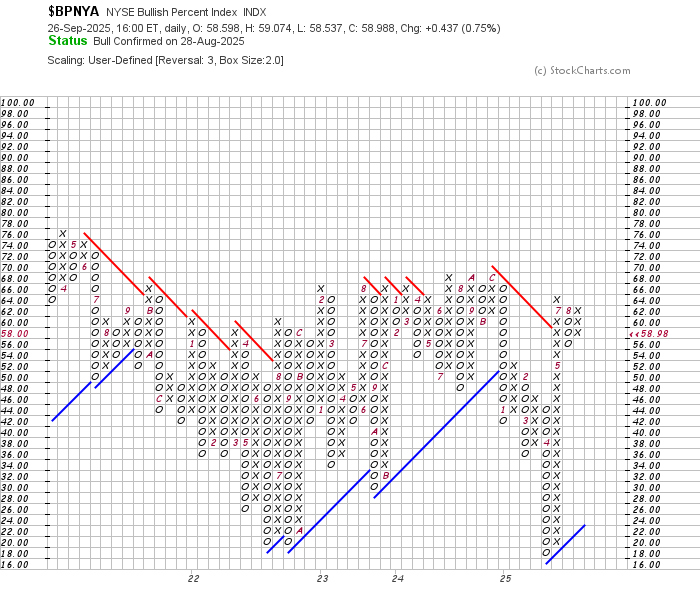

🧠 Breadth

While you’re there, revisit The Bullish Percent Index: A Technician’s Breadth Signal and then consider these charts:

Click here to compare to last week’s charts.

What’s different?

And what are they telling you?

Divergence this week: % of SPX above the 50d fell while % above the 200d rose.

This rare split between short- and long-term breadth often signals digestion phases — but when the 200d rolls, that’s historically where corrections accelerate.

🧭 Now What?

Short‑term: Indices defended support but momentum cooled. Breadth divergence suggests chop or rotation. Dollar strength and bond action now key inputs. Eyes on how SPX and QQQ handle their 8–21d ranges next week.

Medium‑term: Longer‑term trends intact. Rotation opportunities emerging — leaders still strong while speculative pockets look vulnerable. Dollar extension higher could pressure risk assets.

Long‑term: Primary uptrend intact. Reversals have reset conditions without breaking structure. Expect digestion, rotation, and selectivity. A breakdown in 200d breadth or rapid dollar acceleration would be the warning flag.

🗓 The Week Ahead

Nike earnings Tuesday

ADP jobs Wednesday

Jobless claims Thursday

Nonfarm payrolls Friday

Seasonality plus catalysts make for an important start to October.

🙌 Thanks for Reading

Thanks for following this week’s 📈Weekly Charts📉.

For a deeper dive, check out the new Chart School section — lessons on breadth, relative strength, AVWAP, and more.

Here’s to navigating October with clarity + confidence.

✅ Follow @Andy__Moss on X

✅ Subscribe — free & paid versions

✅ Share & comment on what stood out

If you’ve found these breakdowns useful, consider supporting with a paid subscription to keep them coming.

All posts remain public — no locked content. Just charts, signals, and steady updates to help you trade with confidence.

—Andy

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.