Bitcoin, Inflation, and the SEC Walk Into A Bar

Stop me if you've heard this one - Market Update January 11, 2024

The News

Bitcoin Exchange Traded Funds are finally here.

With much anticipation and a couple of odd mishaps, the long-awaited approval for Bitcoin ETFs was finally announced yesterday — after being announced — and then unannounced — the day before.

Tuesday afternoon, a post on X indicated that SEC approval had been confirmed. That post quickly disappeared, and then this one showed up.

Truth is stranger than fiction.

Yesterday, the announcement was made again — and confirmed — after some confusion and the possibility that the same ‘compromise’ had happened again. Doh!

But the SEC quickly said, “No, for real this time.”

Today, 11 ETFs began trading, including symbols IBIT and HODL.

It was a rocky start in multiple ways.

The Markets

Stocks sold off today, too, on slightly higher-than-expected inflation data (CPI). Charts looked to be damaged as the selling tested support levels and short-term moving averages.

Small caps took it the hardest, down more than -1.50% at the lows.

However, an afternoon rally muted the impact, and things looked much better at the close. ‘Buy the dip’ is still alive.

9 of 11 SP Sectors were still lower on the day, though. Energy XLE and Tech XLK were the only ones to close positive.

Special Announcement!

Some exciting new features are coming to Trading-Adventures.com.

You’ve seen the newest educational article - Chart School.

You’ve seen (and subscribed to?) the YouTube channel.

Now, get ready for another exciting addition coming later this month.

If you’re visiting or reading on the website, make sure you get the news by subscribing now.

And if you’re one of the many new subscribers, thanks for signing on!

Keep an eye out for updates to the ‘Start Here’ and ‘About Me’ pages - coming soon.

The Charts

SPY continues the bounce from Monday despite a quick dip today. It's back near the highs again, with the 21-day MA pushing steadily higher. Can it close the week with a breakout?

QQQ isn’t as close to its recent high. And the 8-day is below the 21-day MA. Today’s ‘dip buy’ rally shows strength. Can new highs come in to confirm?

IWM is still the laggard, trading beneath the short-term averages, and even looked to be at risk of breaking down early in the day. A follow-through rally lifting it back over the 8 and 21-day is needed to confirm the repair.

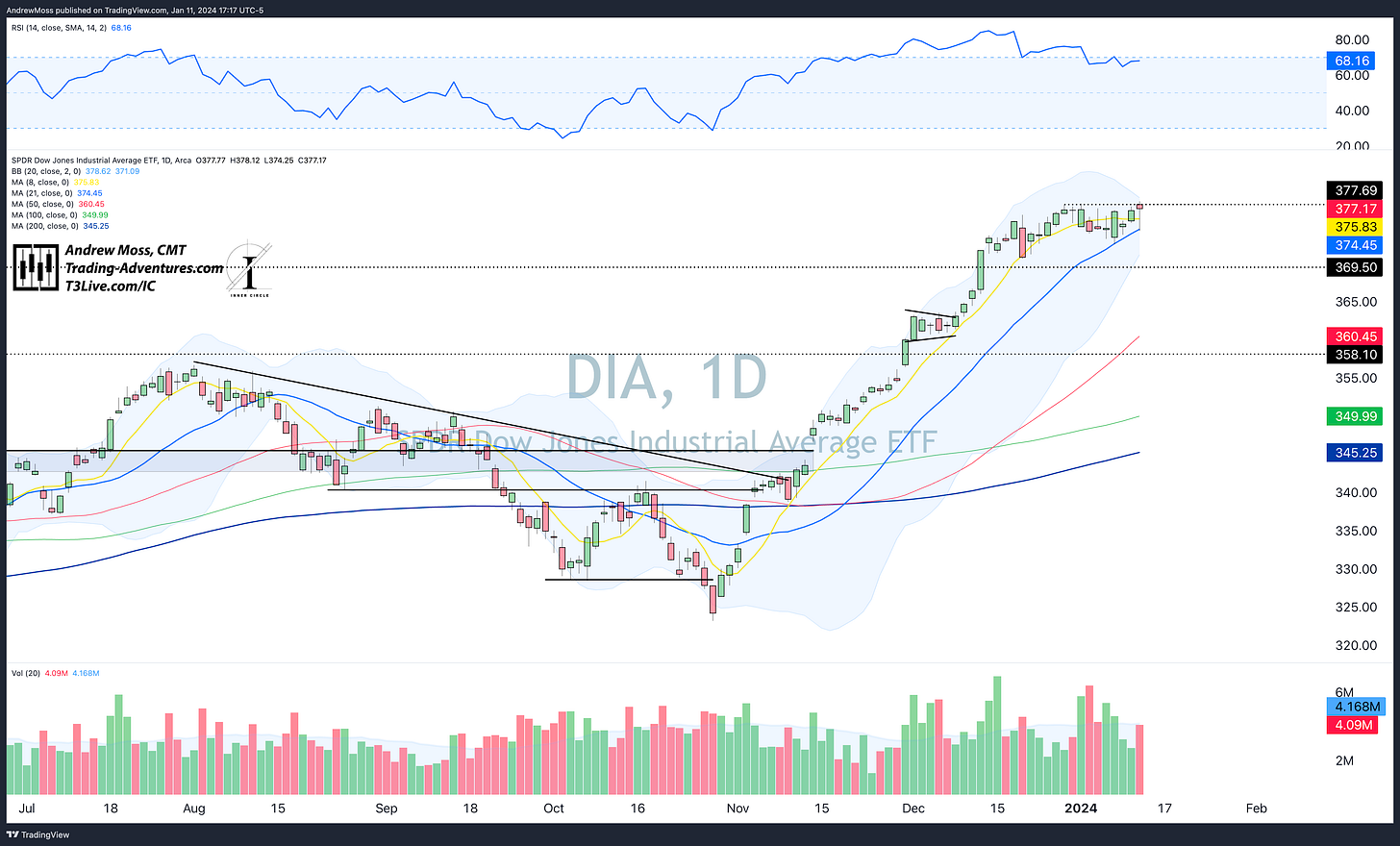

DIA closed near the highs after trading below its 8 and 21-day MA and is close to another breakout now.

TLT has touched or crossed its 200-day moving average for seven days. Can it get above and stay there?

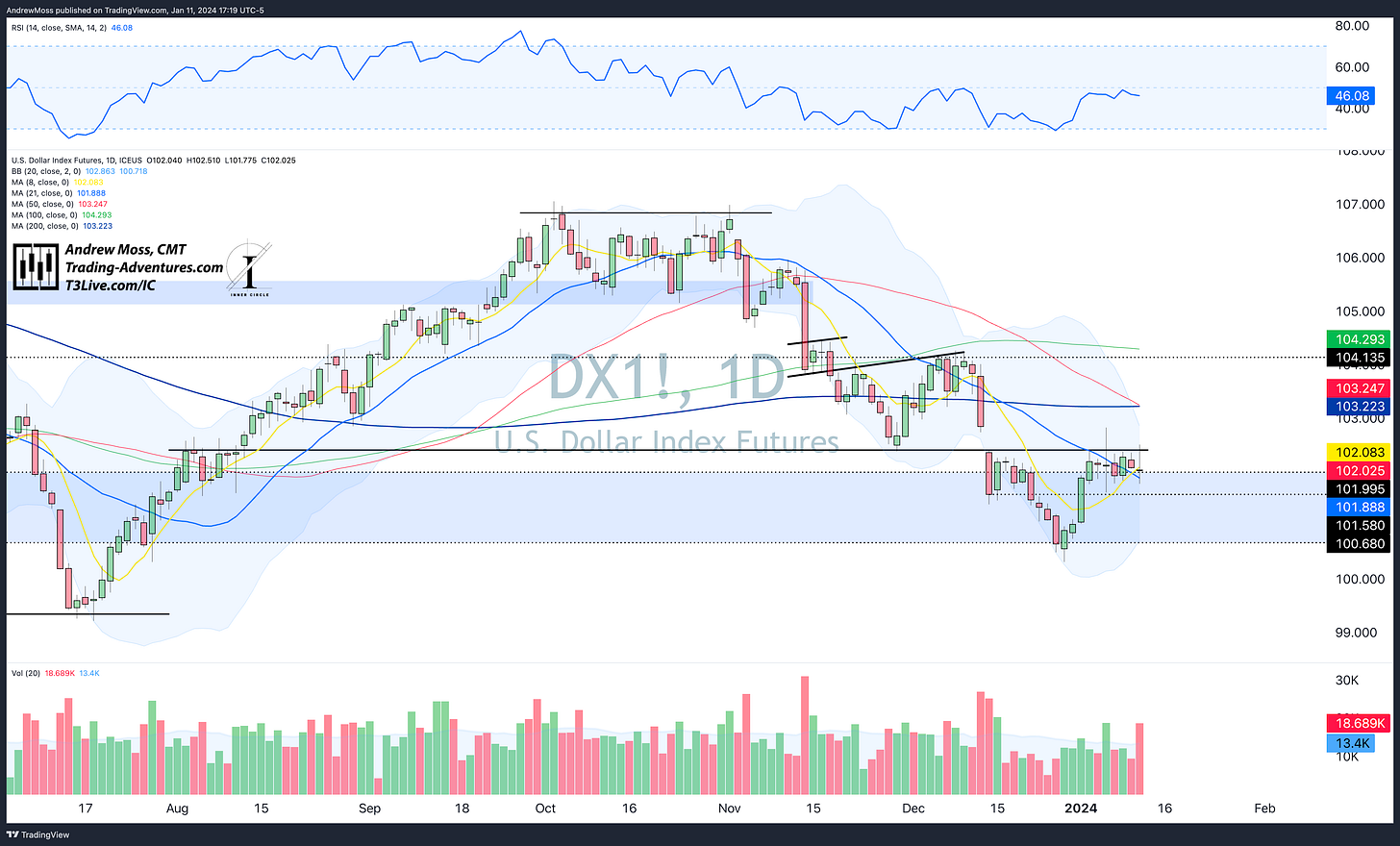

DXY The Dollar stayed below the support/resistance line for seven days. Another failed breakout attempt today is a good sign for stronger stocks.

BTCUSD The ETF approval and launch was a ‘sell, no buy, no sell the news’ event for Bitcoin. Lots of action in three days without any resolution. It continues to consolidate the breakout for now.

The Closing Bell

This afternoon, there was a strong rally as the buyers wouldn’t be scared off so easily by the CPI data. More inflation data (PPI) will come tomorrow morning, accompanied by earnings from some big banks - Citigroup, Bank of America, JP Morgan, and Wells Fargo.

Plenty of market-moving action.

Also, there will not be a Weekly Chart review this coming Saturday due to a quick family trip to the mountains and, hopefully, the snow.

But markets are closed on Monday for the Martin Luther King, Jr. holiday. So maybe a ‘catch-up’ look then.

Elevate Your Trading

Education, training, and support for your Trading Adventure.

Options Trades - Weekly trade ideas are delivered to your email or text messages in language you can easily understand.

Check out EpicTrades from David Prince and T3 Live. Epic Trades from David Prince

Community - Are you an experienced trader seeking a community of professionals sharing ideas and tactics? Visit The Inner Circle, T3 Live’s most exclusive trading room - designed for elite, experienced traders.

Prop Trading - Or perhaps you are tested and ready to explore a career as a professional proprietary trader? 3 Trading Group has the technology and resources you need.

Click here to start the conversation:

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”), an SEC-registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent that person’s opinions only and do not necessarily reflect those of T3TG or any other person associated with T3TG.

Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual, or it may reflect some other consideration. Readers of this article should consider this when evaluating the information provided or the opinions being expressed.

All investments are subject to the risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants, or other qualified investors before making any investment decision.

POSITION DISCLOSURE

January 11, 2024, 4:00 PM

Long: n/a

Short: n/a

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike