Breadth Builds, Rotation Continues, and One Wildcard Shifts

The Markets

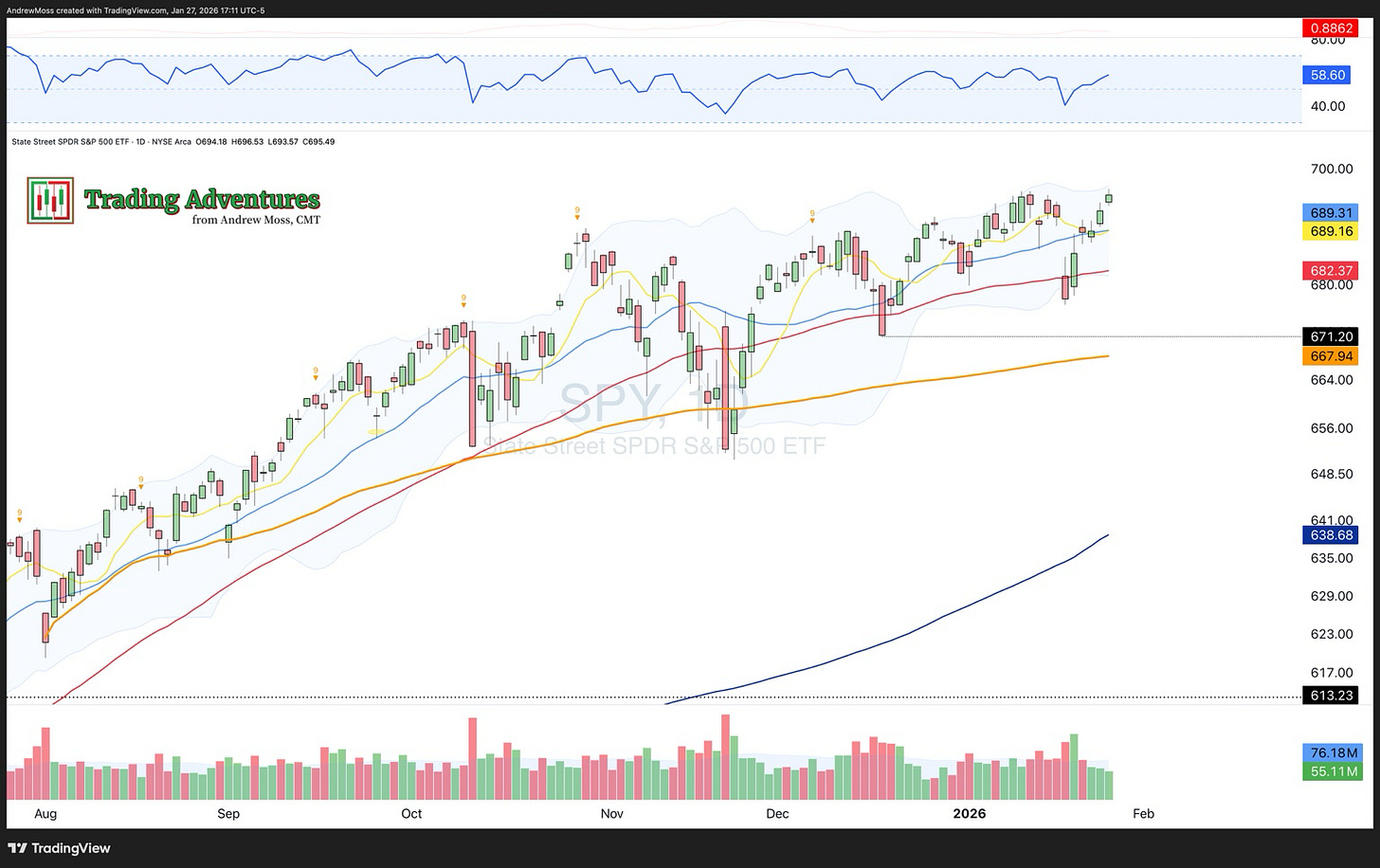

SPY closed at new highs today — but the internal dynamics tell the real story.

Breadth continues to improve. The percentage of S&P 500 stocks above both their 50-day and 200-day moving averages is climbing, signaling broad participation — not just a top-heavy move.

At the same time, the MAG7/SPY ratio is showing signs of a failed breakdown. As noted in the January 16th article, The Deck is Stacked with Strength, Yet One Wildcard Remains, this was the structural piece that hadn’t yet confirmed. Now, it might be.

That said, a few red flags are worth noting:

The U.S. Dollar Index ($DXY) just posted a 7-day selloff, sharper than many other moves over the last year.

Bitcoin and other cryptocurrencies remain weak — no sustainable sign of risk-on appetite there.

Gold and precious metals continue to surge — traditionally that suggests capital rotation into safety. However, current action looks incredibly speculative.

Bonds and interest rates are muted — not bullish, not bearish, just quiet.

And of course, plenty of macro noise looms — but we stay focused on price.

SPY made a new all-time closing high today, January 27, 2026

The Charts

% of SPX Above a 50 and 200-day Moving Average

Breadth data confirms internal strength — not just cap-weighted gains.

MAGS/SPY

This failed breakdown potential could mark a shift back to leadership — or at least participation — from the big names.

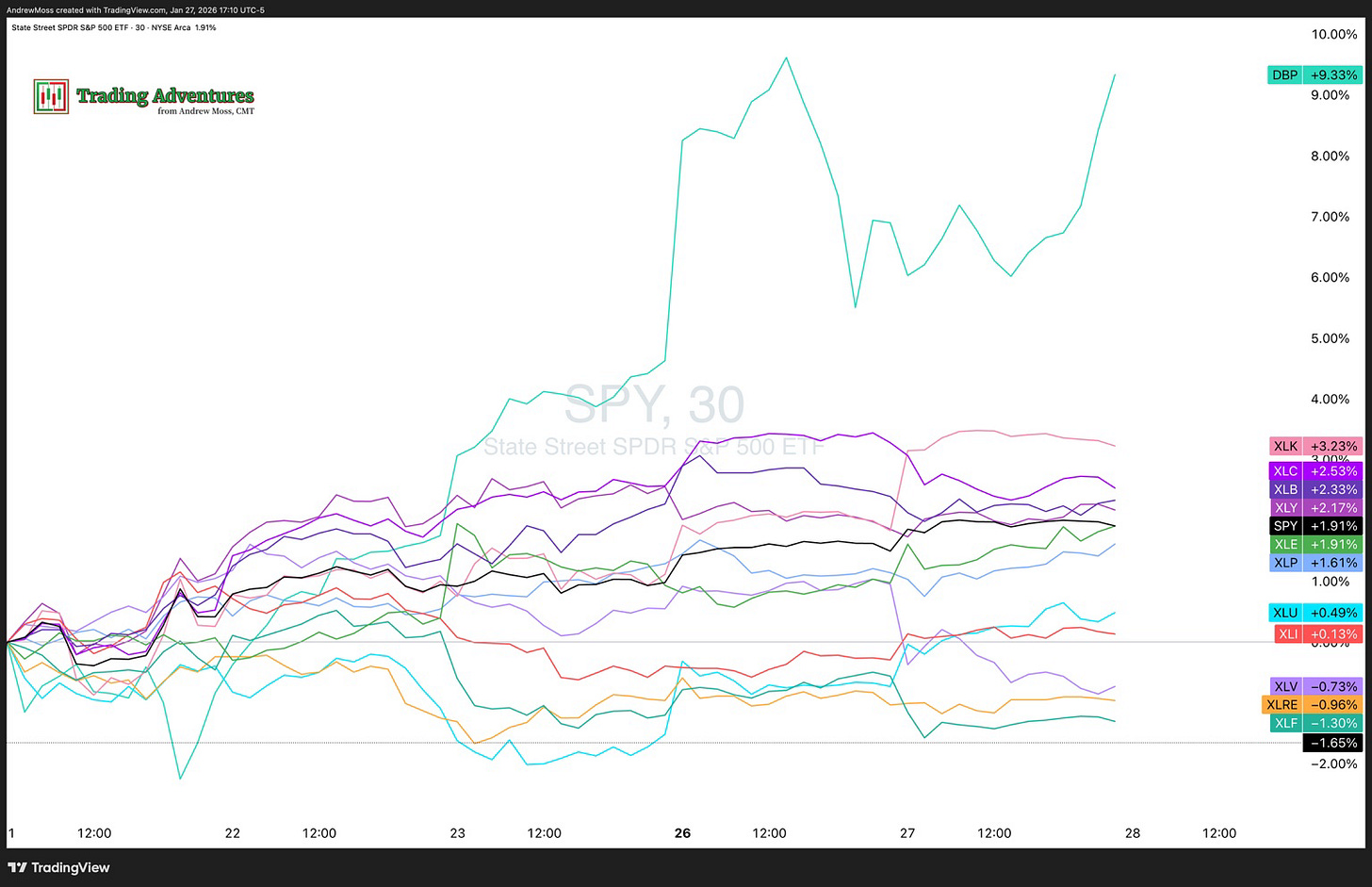

SP Sector Performance

In last week’s post — Rotation or Retreat?, we highlighted strength in staples and metals while discretionary and tech lagged. One week later, that has flipped:

Performance since Jan 20:

Tech +3.23%

Communications +2.53%

Staples +1.61%

It’s not about prediction — it’s rotation.

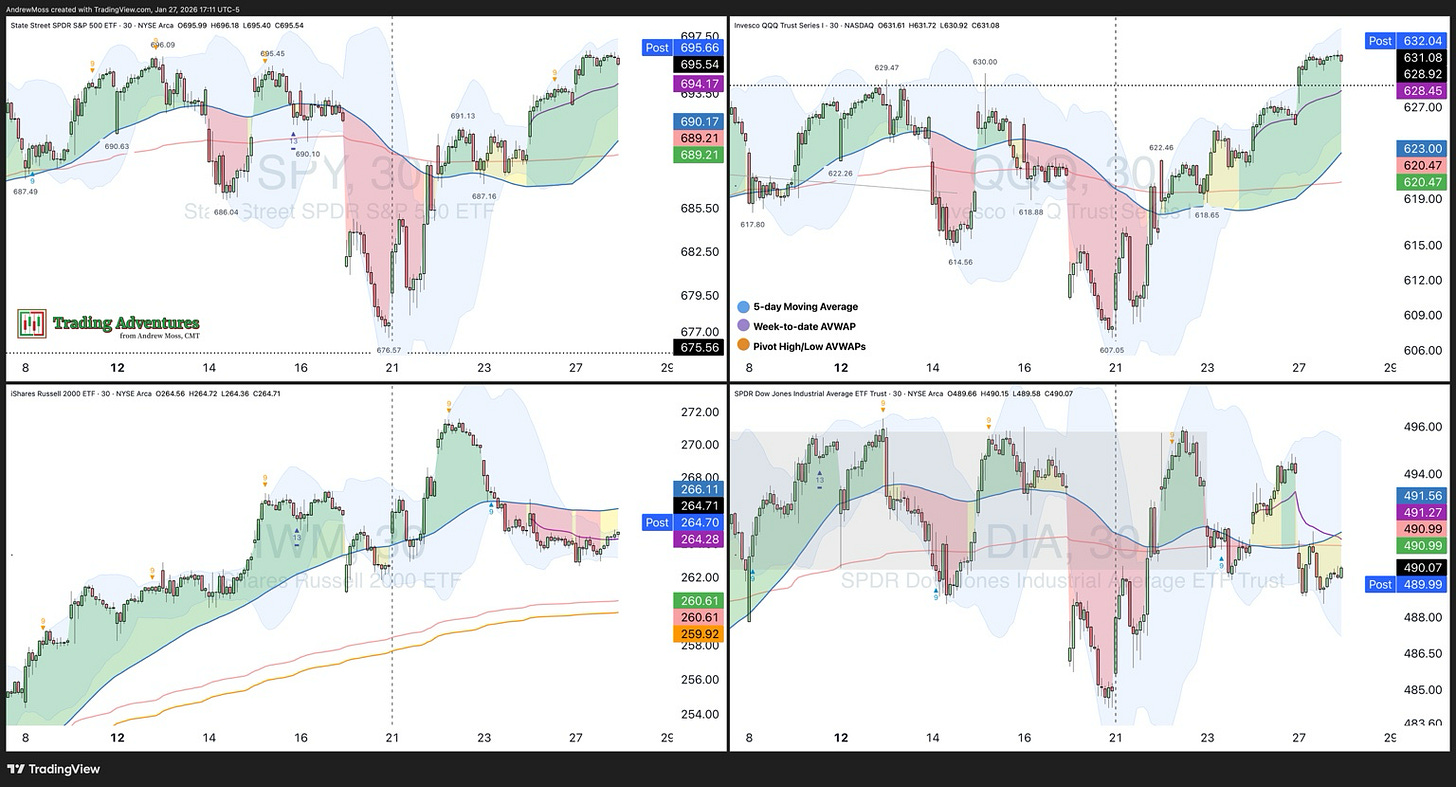

ETF Roadmap

Leadership has shifted again. Small caps IWM and the Dow DIA were strong early. Now SPY is taking control, and QQQ is close behind.

The Trade

This isn’t just noise — it’s structure.

Structure that supports continued upside, if it holds.

Breadth expansion, improving sector rotation, and a possible MAG7 catch-up all align with a trend still intact.

That doesn’t mean everything is risk-free. Dollar weakness, crypto stagnation, and the safety bid into metals are reminders: respect risk first.

No need to predict.

Just follow the trend.

And let price confirm.

If you like how I think here, this is where that thinking is applied every day.

Important: This content is provided for educational purposes only. If you’re reading this online, please review the full disclosure here.

Another breath of fresh air for the mind. Thanks for the clarity of perspective. I greatly appreciate the reinforcement of Alphatrends' strategies with your addition and partnership. A current environment focus I can absorb without concern for diversive redirection.