📈Weekly Charts📉 January 10, 2026

Good morning ☕️

The first week of 2026 is in the books and stocks are green 🟢 across the board.

Did they just set the tone for the whole year?

Let’s take a look, with the Weekly Charts.

Subscriber Note

A subscriber-only update is coming soon, shared exclusively with Trading Adventures readers.

🔹 Small Caps Lead

IWM delivered a powerful start to the year, jumping +4.6% from last week’s close — a textbook January Effect in action.

New higher highs

Built on higher lows

Price above the upper Bollinger Band

Above all key moving averages

Healthy volume

✅ Uptrend confirmed

🔹 Large Caps Follow

SPX printed a new high, finally closing above the 1.618 extension.

Riding upper Bollinger Band

10-week MA just below

Volume is strong

RSI is firm, not extended

Trend remains intact

QQQ broke out of a multi-week consolidation:

Confirming volume

Supportive RSI

Strong positioning above all MAs

Constructive and building

DIA pushed to new highs

Clean structure, strong volume, aligned MAs

Supports continuation

🔹 International & Bonds

ACWX: 3-week rally with classic gap-and-go

Volume doubled again

Above all key MAs

Trend advancing

FXI didn’t participate this week. It’s not broken — but price stalled below recent highs, with congestion near key moving averages and tightening Bollinger Bands.

The question now:

Is this relative weakness a signal?

Or is is just coiling for a catch-up move?

AGG and TLT: Quiet

HYG: Strength on uptick volume

Nothing urgent, just worth a glance.

🔹 Macro Views

DXY: Trying for a reversal

Touched 99.26

Back above 40-week MA

Closing on 10-week MA

Still below key supply

BTC: Still rangebound, no confirmation

Below AVWAP and 10-week MA

There were tradeable moves on lower time frames, but no follow-through.

Price remains inside the weekly range, below the relevant AVWAP, and under a declining 10-week MA.

No signs of meaningful progress — yet.

GSG: Commodities compressing in multi-year range

Higher lows

Tightening structure

Repeated tests of resistance suggest energy is building

Digging into the group, and skipping precious metals (you've already seen 4000 silver charts, right?) Base Metals are making moves.

DBB: Base metals breakout

Cleared key retracement with conviction

The trend is strong

RSI is getting stretched

Volume enormous

USO: Despite recent news, oil remains stuck in its range.

Price is below key resistance and the trend remains unresolved.

No technical shift here — just noise for now.

🔁 Relative Strength Highlights

IWF / IWD: Still tilting toward value

XLY / XLP: Discretionary takes the handoff

SPHB / SPLV: Still risk-on

SPY / IWM: Possible trend change — large caps may be passing the baton

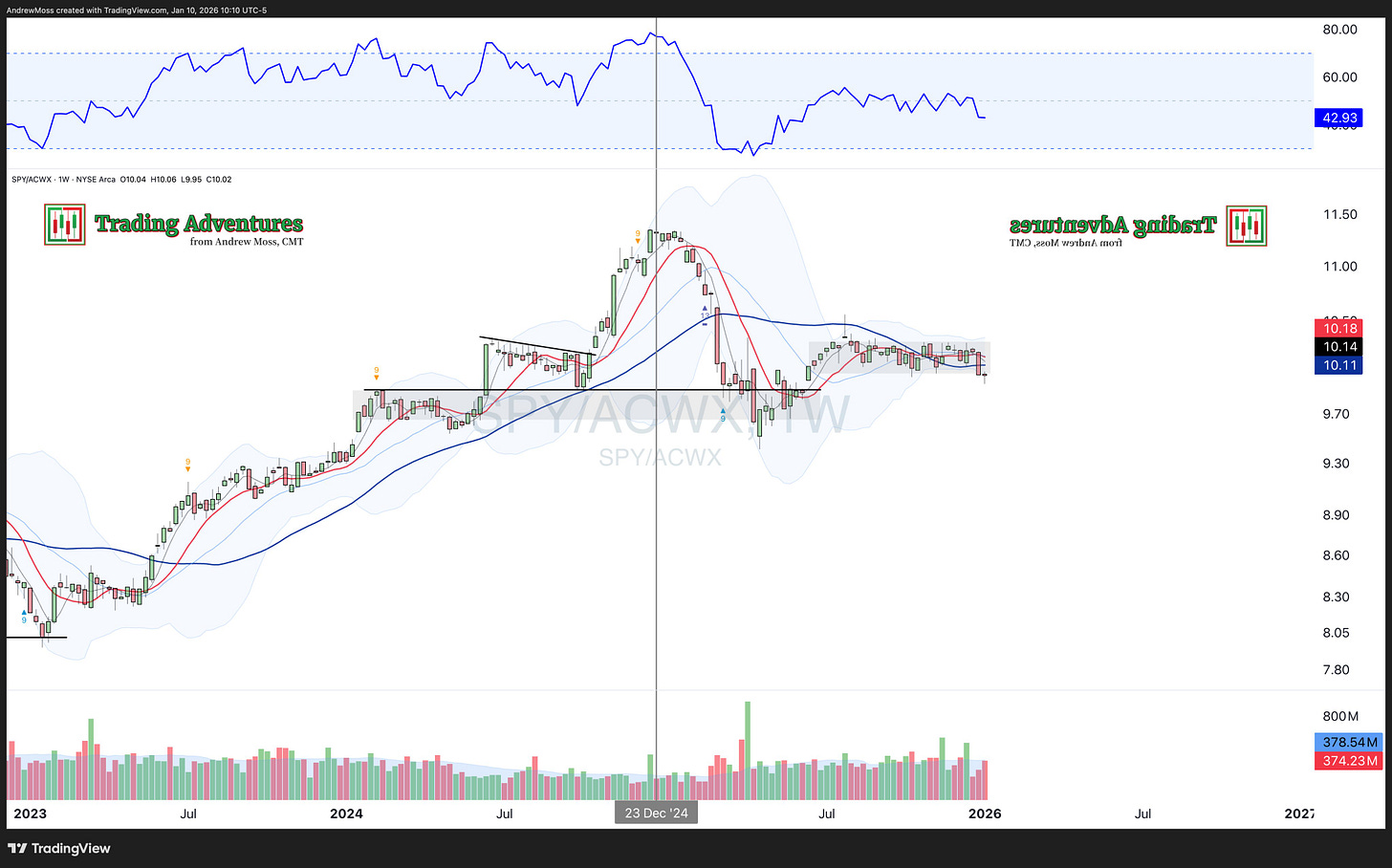

SPY / ACWX: Starting to look like a mirror image, possibly forming a head & shoulders

SPY / AIA: Lower highs & lows beneath AVWAPs — “descending the stairs”

SPY / MAGS:

Remember when “Mag7 is the only thing holding this up”?

Note the potential turn. Then consider what you see in AAPL, META, MSFT, NFLX.

Relative Strength — What Is It? (Really) in the new Chart School section.

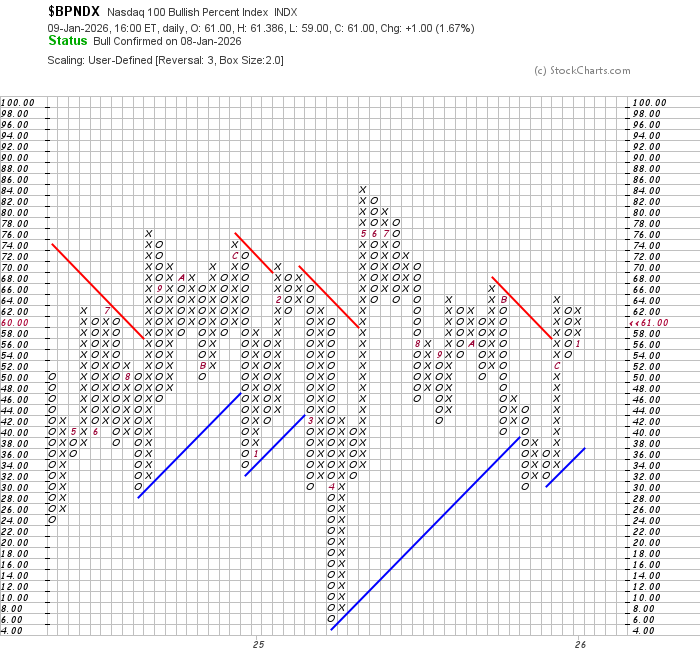

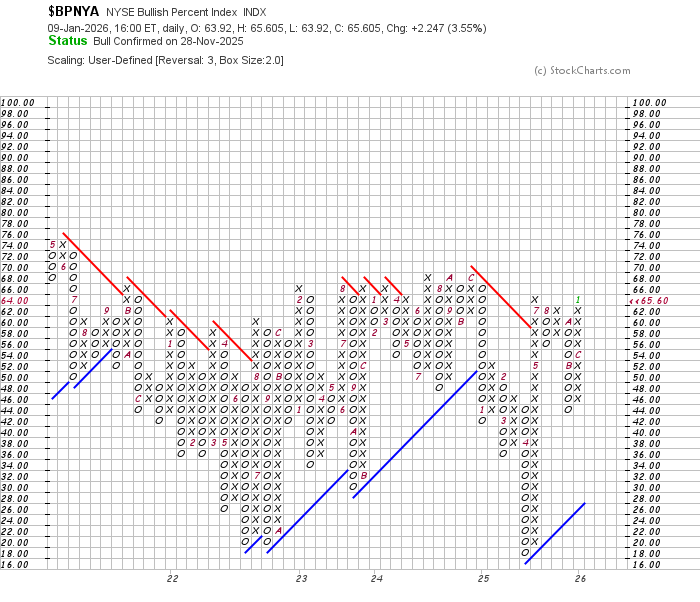

⚖️ Breadth

Breadth surged — % of $SPX stocks above the 50- and 200-day MAs rose sharply

Bullish Percent Indices ($BPSPX, $BPNDX, $BPNYA) all jumped

More stocks now flashing Point & Figure buy signals

Read this for a refresher:

🧭 Now What?

Short-term 🕒

Momentum remains strong — but many names are extended.

Avoid chasing

Look for consolidation or pullbacks

Earnings season begins this week and could bring volatility

Be selective and stay alert. This is where patience pays.

Medium-term 📆

Breadth expansion and sector rotation support the trend

Risk-on ratios lean bullish

Leadership groups are emerging

Relative strength themes are gaining traction

If this holds, Q1 should stay constructive.

Long-term 🧭

The primary trend remains up — but it won’t be a straight line

Macro risks persist

Manage your risk

Respect price

Stay flexible and data-driven

Let price lead — not your bias.

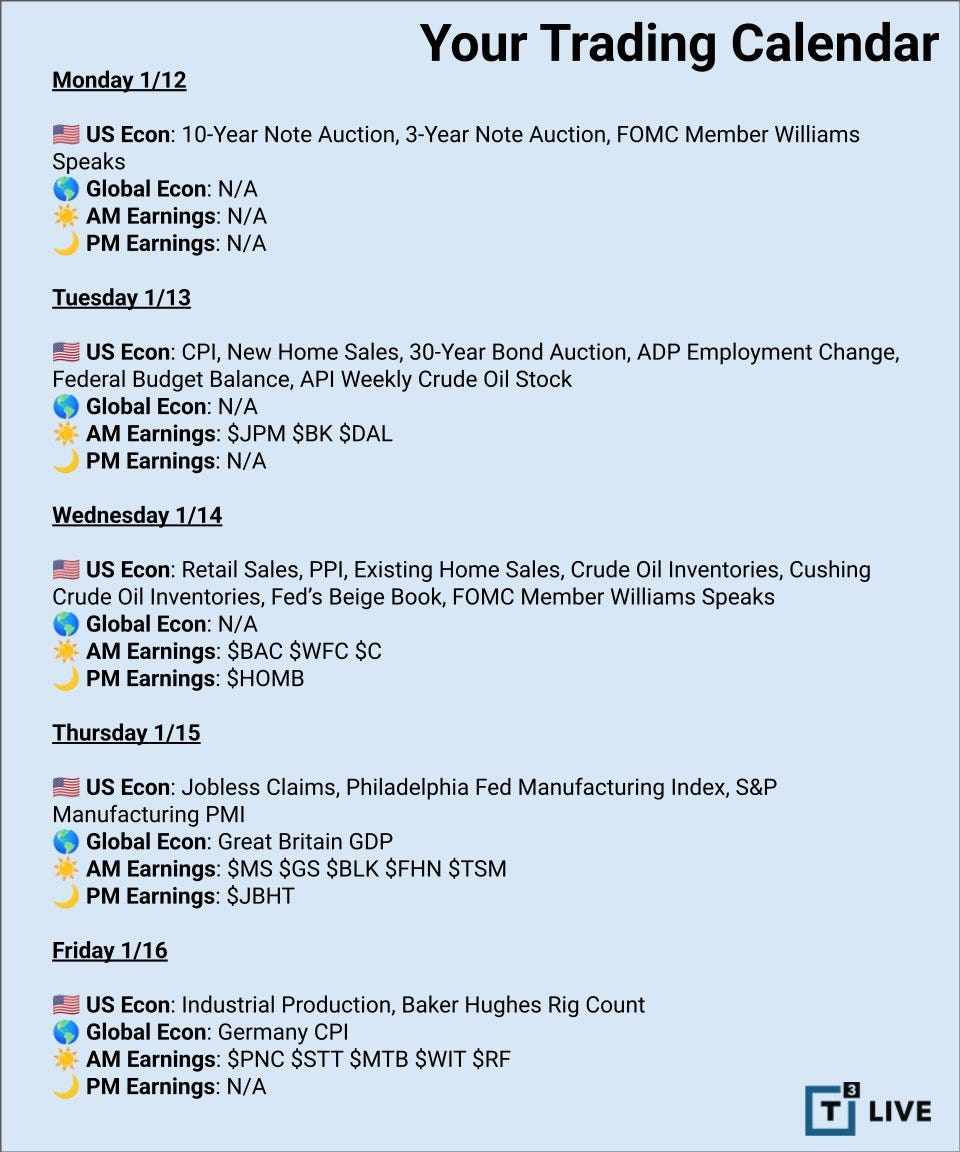

🗓 The Week Ahead

Bank earnings: JPM BK BAC WFC C MS GS BLK RF

Econ data: CPI, PPI, Home Sales, Jobless Claims

Be ready and aware.

🧠 Final Thought

It’s been a wonderful start to 2026.

But don’t get giddy — or complacent.

The weeks aren’t always this easy.

Setups continue to emerge.

Stick to your rules.

Trust your process.

And always manage your risk.

🙌 Thanks for Reading

Thank you all for reading and spending some time with me on a Saturday morning!

If you found this week’s charts helpful, please -

📤 Share

💬 Comment

♻️ and Repost

It helps more traders see the work and join the discussion.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.