Small Caps Time To Shine?

Monday Market Update - January 22, 2024

The News

Earnings season is here.

Intel, Netflix, Tesla, and many others report this week.

Expectations could be high in such a strong market. The near-term reaction will be all about whether or not they can live up to the hype.

We also have PCE (Personal Consumption Expenditures) data on Friday. This is the Federal Reserve’s most preferred gauge of inflation. Good news could be a solid positive catalyst, especially for small caps.

Here’s the situation.

The Markets

This is how we started the week.

Russel 2000 Index Futures, before regular market hours this morning, with only the AVWAP and falling wedge pattern.

If you’ve read any recent articles here, you know small-caps have been a focus and that the IWM chart is included each time. Recently, that chart has been accompanied by comments reminding that small caps have been lagging and that their participation to the upside is an integral part of the overall bull market picture.

“IWM is still the laggard, trading beneath the short-term averages” - Jan. 11, 2024

“Small caps … are struggling.” - Jan. 18, 2024

Today, that story could be starting to change. $RTY futures did break out. The rally took prices up to the 21-day MA and a recent pivot level.

It’s a start, but the job is far from finished.

Russel 2000 Index Futures with all the usual indicators

On to the rest of the charts after this special announcement.

Special Announcement

Some exciting new features are coming to Trading-Adventures.com.

You’ve seen the newest educational article - Chart School.

You’ve seen (and subscribed to?) the YouTube channel.

Now, get ready for another exciting addition coming later this month.

If you’re visiting or reading on the website, make sure you get the news by subscribing now.

And if you’re one of the many new subscribers, thanks for signing on!

Keep an eye out for updates to the ‘Start Here’ and ‘About Me’ pages - coming soon.

The Charts

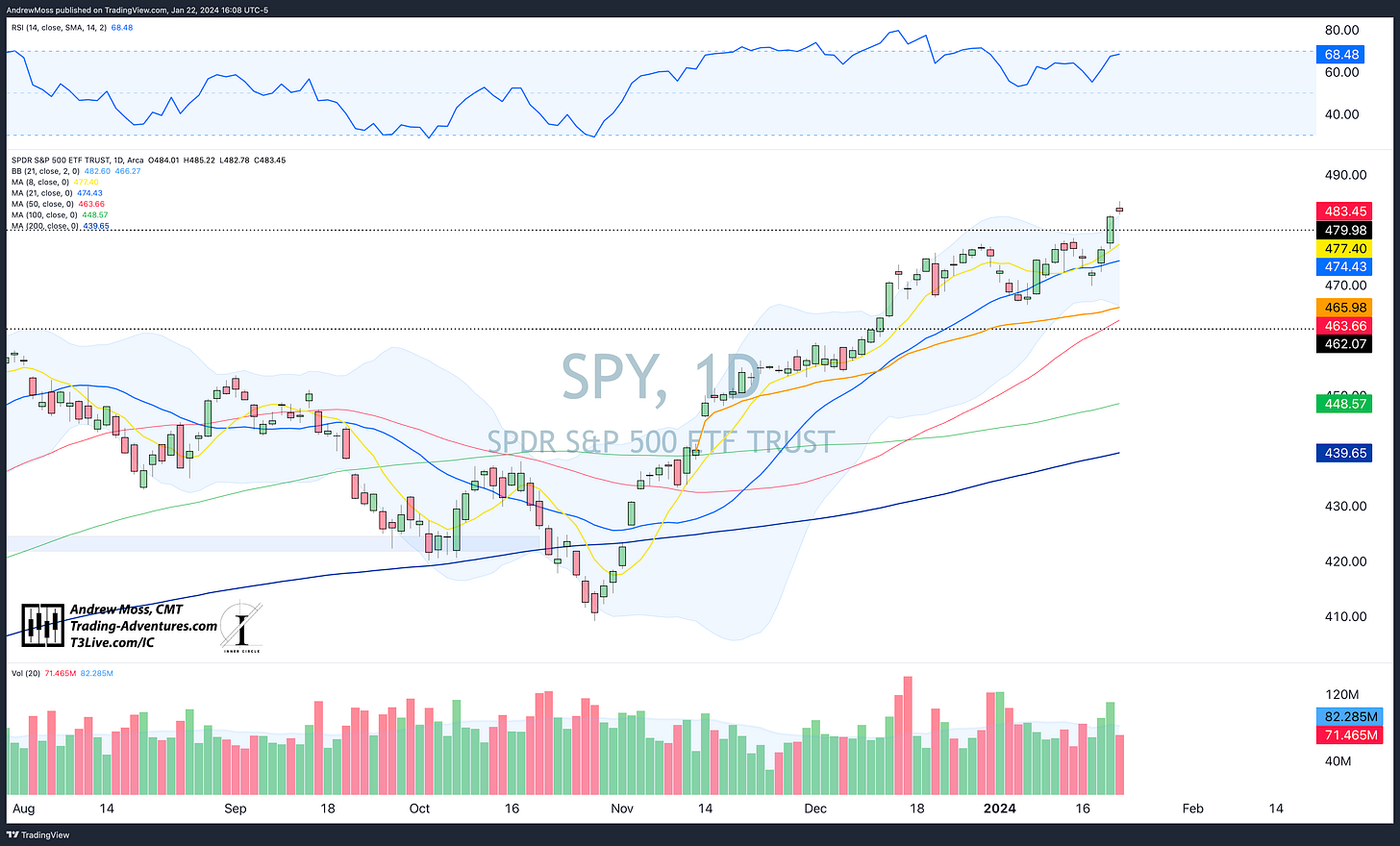

SPY starts the week with a gap-up. But, it ends the day with a potential shooting star candle. With RSI nearing overbought status and price being (once again) extended far beyond the 8 and 21-day MAs, some consolidation may be in order.

Then again, buying strength hasn’t faded for very long lately.

QQQ is in the same situation, except that RSI is already technically overbought.

IWM - today’s focus breaks out strongly and moves into the 21-day MA and a pivot area. Day 3 higher for this index takes it back into equilibrium rather than an overbought status. Price spanned that gap from the 8-day to the 21-day MA, and RSI is just north of the halfway point.

A move back above $200 will restore much confidence in the small-cap space. The question now is, does it even wait for potentially bullish data on Friday? Or do traders front-run the expectation and put the move in early?

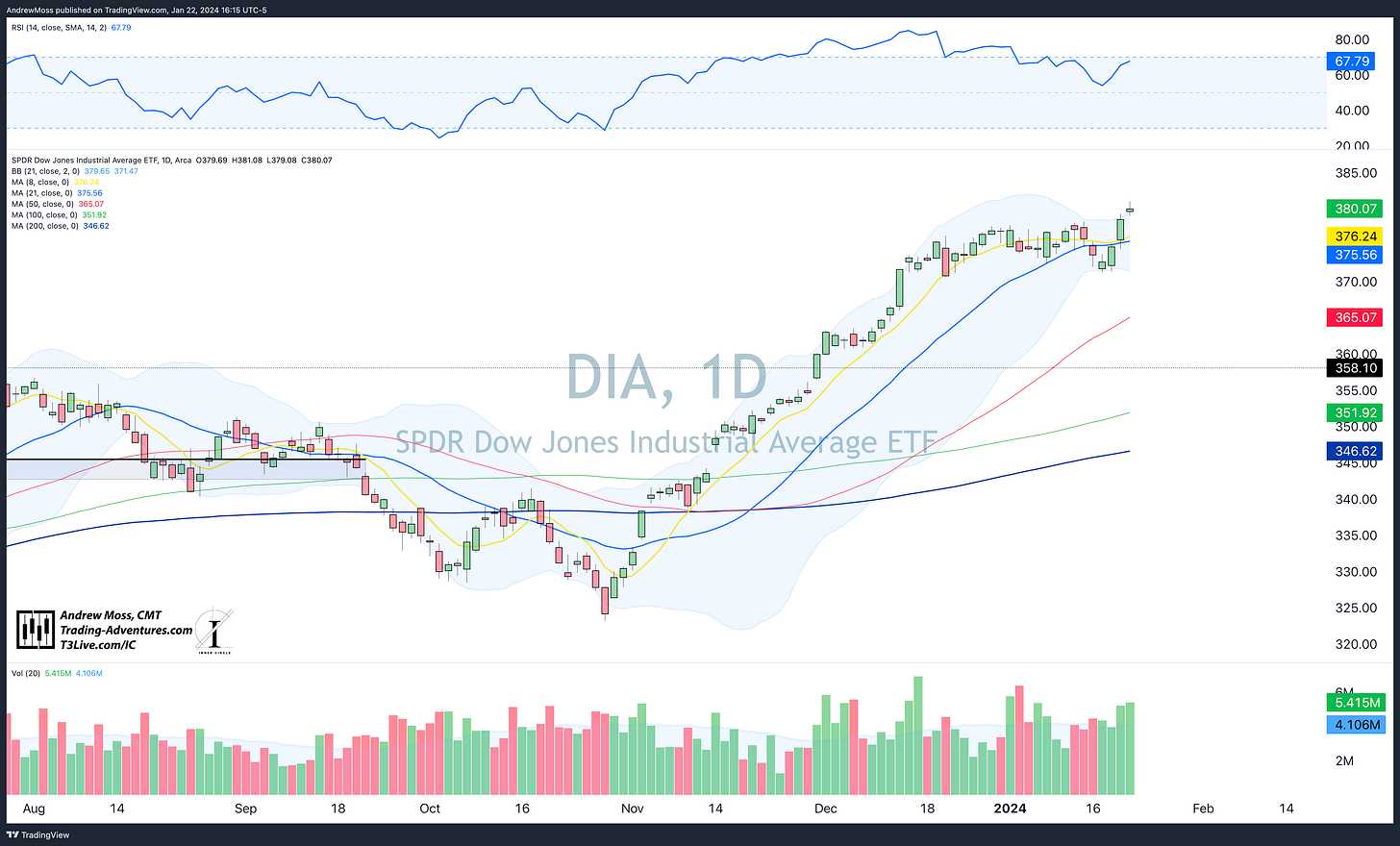

DIA breaks out of the consolidation range and into new highs. It’s not nearly as extended as the other large-cap indexes, and the 8-day MA is just starting to get separation above and away from the 21-day MA.

There is more room above if buyers continue to push.

TLT - another potential beneficiary of bullish PCE data, puts in a positive day and is now sandwiched between the rising 50-day and falling 8-day MAs.

DX1! US Dollar futures stayed subdued and below the support/resistance zone and the swing high AVWAP. A break lower from this four-day consolidation would help stocks.

The 8 and 50-day MAs are just underneath to try to prevent that from happening.

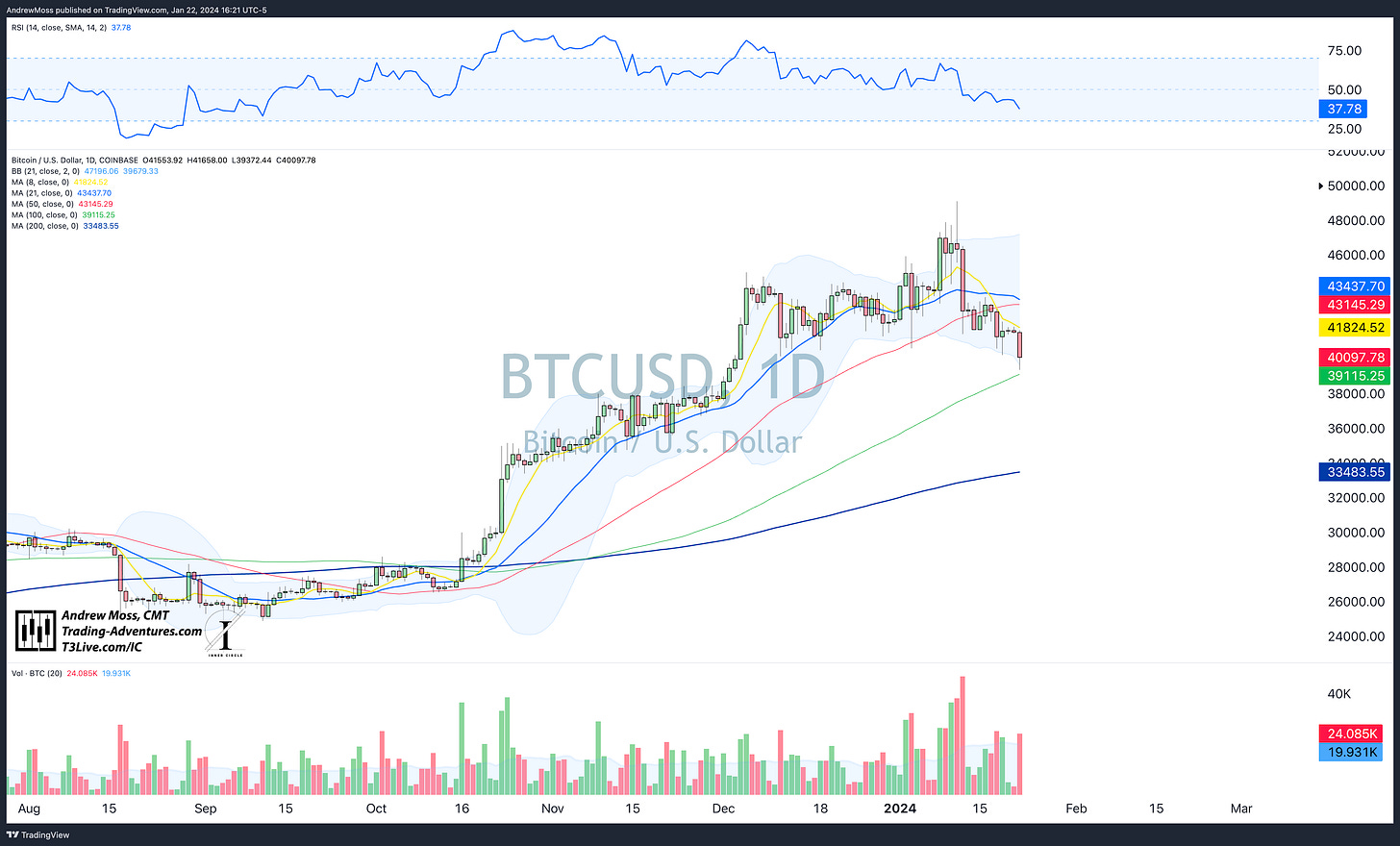

BTCUSD Bitcoin broke support to continue lower and nearly test its 100-day MA. A pivot area near $38,000 is the next potential support after that.

The Closing Bell

Stock buyers started the week off strongly. Now, we look to earnings and economic data as market movers.

While we wait:

The next episode in the Chart School video series will be released tomorrow, along with more news about Trading-Adventures.com.

Make sure you are subscribed to the YouTube channel.

And keep an eye on your inbox on Tuesday.

Elevate Your Trading

Education, training, and support for your Trading Adventure.

Options Trades - Weekly trade ideas are delivered to your email or text messages in language you can easily understand.

Check out EpicTrades from David Prince and T3 Live. Epic Trades from David Prince

Community - Are you an experienced trader seeking a community of professionals sharing ideas and tactics? Visit The Inner Circle, T3 Live’s most exclusive trading room - designed for elite, experienced traders.

Prop Trading - Or perhaps you are tested and ready to explore a career as a professional proprietary trader? 3 Trading Group has the technology and resources you need.

Click here to start the conversation:

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”), an SEC-registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent that person’s opinions only and do not necessarily reflect those of T3TG or any other person associated with T3TG.

Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual, or it may reflect some other consideration. Readers of this article should consider this when evaluating the information provided or the opinions being expressed.

All investments are subject to the risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants, or other qualified investors before making any investment decision.

POSITION DISCLOSURE

January 22, 2024, 4:00 PM

Long: MARA, MARA0216C22, SMCI, SMCI0126C460

Short:

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike