Consolidation Continues

Monday Market Update - When Do Stocks Breakout?

The News

A quick recap of the last couple of weeks:

First, the rate cuts everyone was sure would come in March got postponed.

And in between those last two we got a Key Reversal Day.

Dizzy yet?

The Markets

Can’t blame you if you are. That’s a lotta action in the last month or so. And after weeks and weeks of strong momentum and new highs, it seems the markets may be a little dizzy, too.

That’s not necessarily a bad thing. Some time to rest and recollect would be healthier for the medium and longer term. And that’s what the charts show as they test or even move below the shorter moving averages.

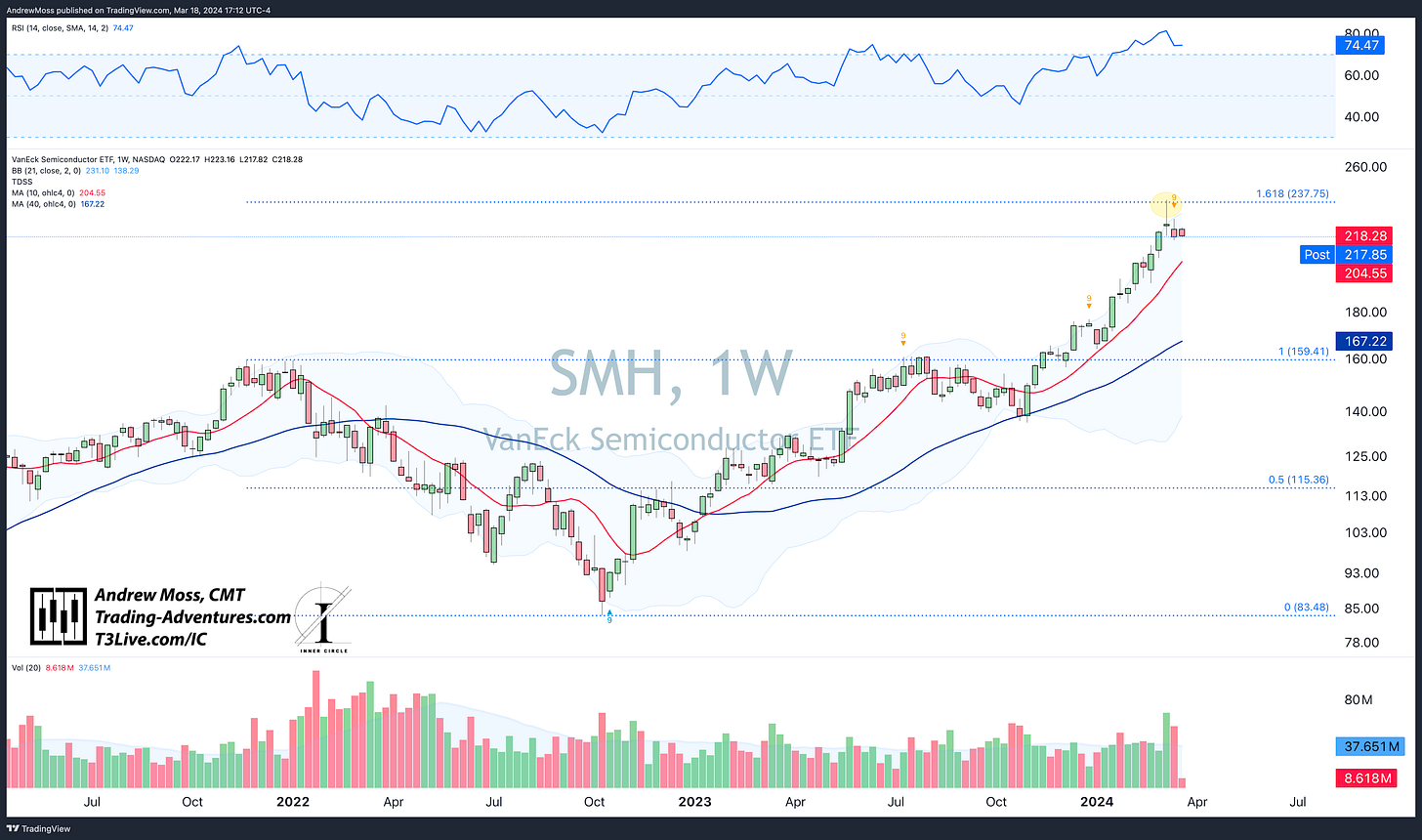

After the reversal candle on the semiconductors Weekly chart SMH (early warning here on March 9), we’ve seen follow-through from sellers and profit takers.

Now, SMCI has tested its 21-day MA today for the first time in 60 days.

AMD has already tested that level.

NVDA looks like it may want to, despite the highly anticipated GTC event.

The Charts

SPY closed below the 8-day MA as the time correction continues.

QQQ stayed in the very narrow range between the 8 and 21-day MAs today after testing the gap Friday. A move lower could see $425-$428 quickly on hawkish talk from Powell. A more dovish tone would likely have it back to the pivot highs near $466.

IWM was below the 21-day MA for day 3 and could see the 50-day MA next, $198.58.

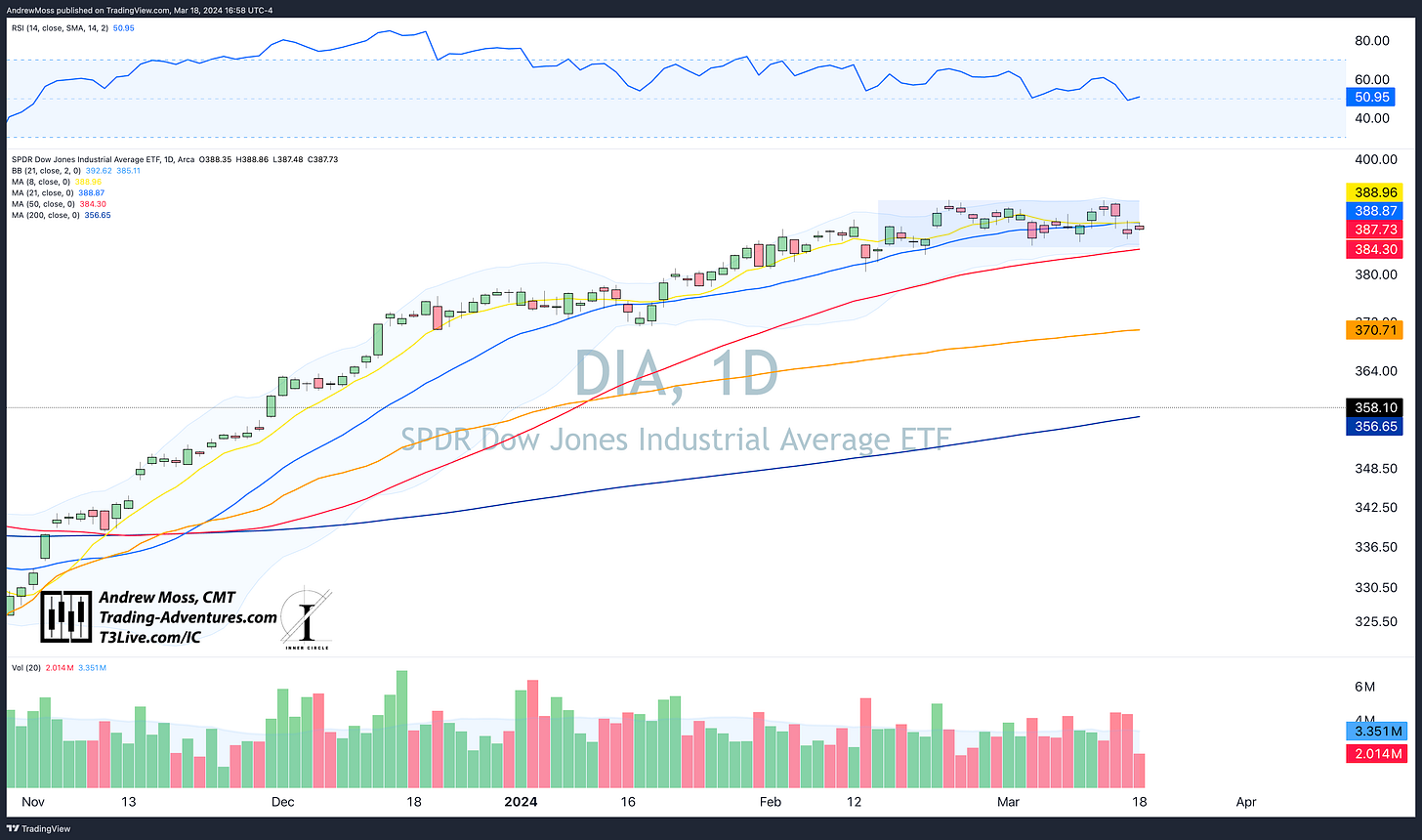

DIA has been in a range of less than $10 for three weeks. The shorter-term MAs are flattening while the medium-term 50-day MA catches up to the price. Watch for movement beyond the range ~ $384-$392.

TLT continues to drift lower and will likely test $91.85 pivot support.

DXY The Dollar is higher but still very subdued. A cluster of MAs at $130.50 is the next resistance level.

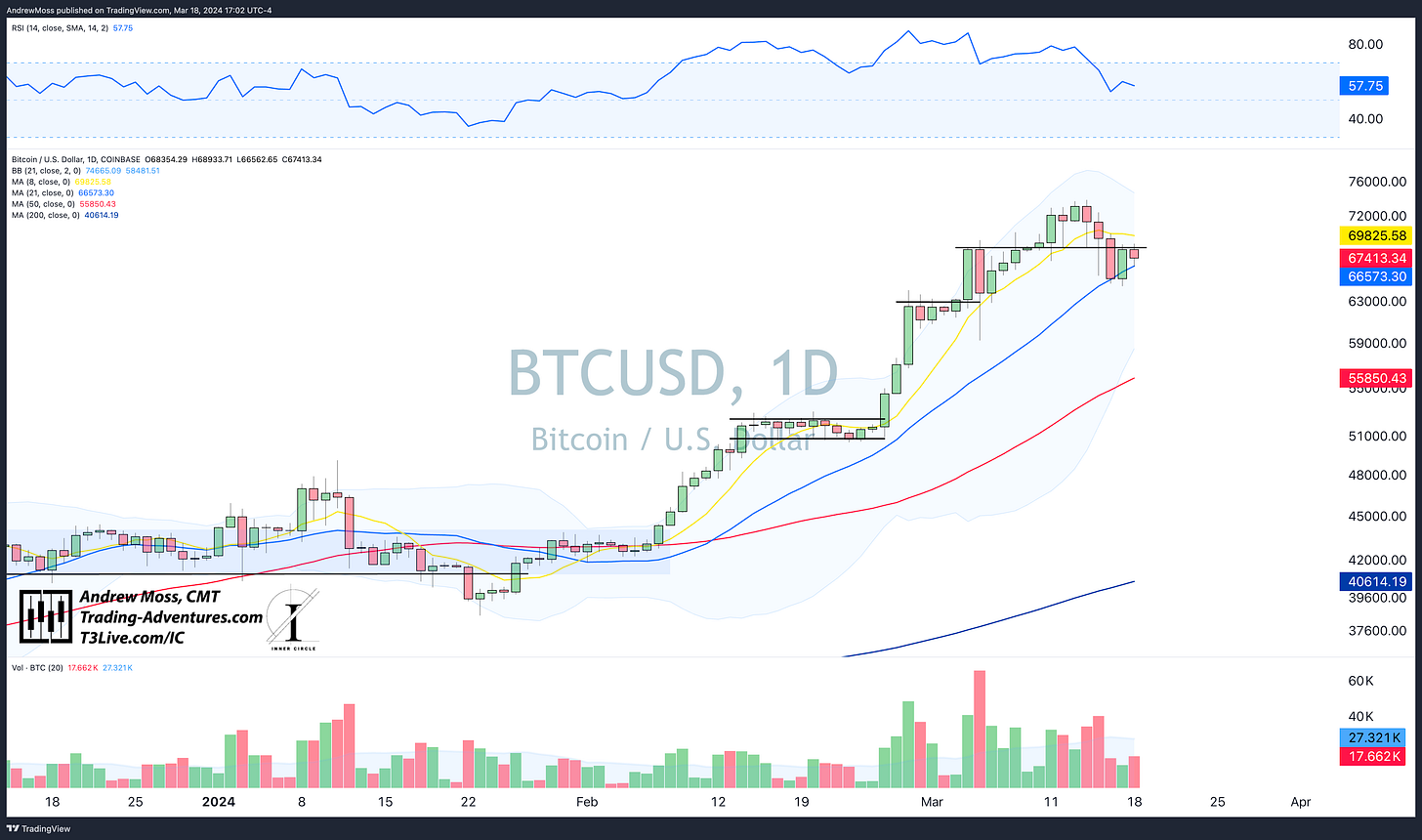

BTCUSD is dealing with overhead supply while riding the 21-day MA for support. More direction may come soon.

The Closing Bell

We still have some key events ahead of us this week. NVDA’s GTC continues through Wednesday, and then we will get the latest FOMC Rate decision and Policy updates.

Back with an update again on Thursday.

Elevate Your Trading

Education, training, and support for your Trading Adventure.

Options Trades - Weekly trade ideas are delivered to your email or text messages in language you can easily understand.

Check out EpicTrades from David Prince and T3 Live. Epic Trades from David Prince

Community - Are you an experienced trader seeking a community of professionals sharing ideas and tactics? Visit The Inner Circle, T3 Live’s most exclusive trading room - designed for elite, experienced traders.

The Inner Circle at T3 Live

Prop Trading - Or perhaps you are tested and ready to explore a career as a professional proprietary trader? 3 Trading Group has the technology and resources you need.

Click here to start the conversation:

T3TradingGroup.com

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”), an SEC-registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent that person’s opinions only and do not necessarily reflect those of T3TG or any other person associated with T3TG.

Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual, or it may reflect some other consideration. Readers of this article should consider this when evaluating the information provided or the opinions being expressed.

All investments are subject to the risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants, or other qualified investors before making any investment decision.

POSITION DISCLOSURE

March 18, 2024, 4:00 PM

Long: IMNM, VKTX0419C80, QQQ0328P437, XBI0322C95

Short:

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike

Yes I do recall the march 8, Nvidia, intraday event. And, you mentioned reversal day that day. Not sure if you meant them specifically or the indexes (or both) / Moss, the s and p has been down 2 weeks in a row. I am not seeing sector rotation (Russell up and down), I figured small caps would have been next but maybe fed policy has something to do with it. Biotech rolled over. And the bond market 🤦♀️ I wish I could buy commodities but have not figured out the best way as a retail trader. I think about to materials sector (but if one thinks hard enough/ it’s all stocks) if you know of a commodity etf let a brother know/ in the meantime in between time… I’ll continue to send retail traders your way. T3 and here. They may make fun of me for not buying solana or whatever but I feel like I have some sort of obligation to help people bc I know some of these people have children and they put all their money into one thing… i try to teach “diversification, trading psychology, technical analysis mostly. “ Love your summaries. And it’s pretty neat you’re the only cmt I know who has a similar accent to me 😂 gives me some hope/. Enjoy your night/ we got money to make and protect tomorrow